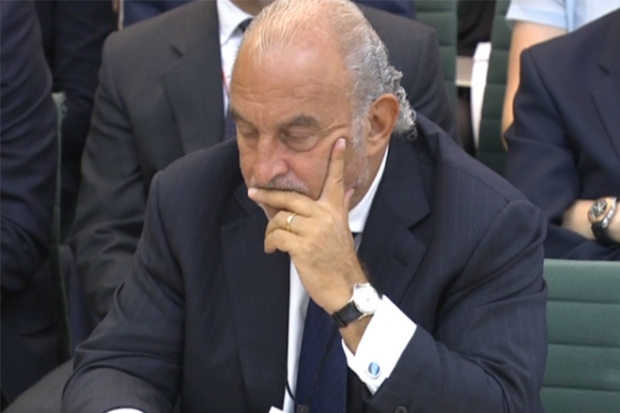

Sir Philip Green To Give Evidence On BHS

The owner of BHS was trying to buy struggling tailor Austin Reed just a month before the department store collapsed, according to new documents published as part of the Parliamentary inquiry into the collapse. During the meeting Green told MPs that there is now “a light in the tunnel” for the scheme.

Despite Green’s personality traits, and efforts to deflect criticism on to others, he did acknowledge he was at least partly at fault.

11,000 BHS jobs are at risk (Picture:PA)Manchester bombing 20 years on: Pictures show devastation caused by huge IRA explosionHowever, Sir Philip claimed that, through his Arcadia retail empire, he had pumped £600 million into BHS after the dividend payments.

“As I said at the beginning, just to repeat it, what happened is beyond frightful, sad, there was zero intention.either I leave here today you think I’m a liar or I’m telling you the truth, but I’m not a liar”.

Adding that the MP’s stares were “really disturbing”.

“We will sort it, we will find a solution”, he said. “We want to find a solution for the 20,000 pensioners”, he said, although he argued that putting the scheme into the Pension Protection Fund – the lifeboat for failed schemes would not resolve the issue, as the schemes are quite complex.

Asked about the sale of loss-making BHS to Retail Acquisitions Ltd, a little known vehicle led by Chappell, for 1 pound in March 2015, the billionaire admitted it was a mistake. “I wanted to come here so that people can see for themselves if I’m honest, dishonest”. Green noted that he was largely influenced by advice from banking behemoth Goldman Sachs who initially “vetted” Chappell and the deal.

The committee heard Green claim that advisers to Chappell, the law firm Olswang and accountants Grant Thornton “did not know him from a hole in the wall”, despite giving him the appearance of credibility ahead of the deal.

“We thought the buyer was legitimate” he said.

Later in the marathon session, Green refuted evidence given by Chappell last week that he forced BHS into administration by calling in a £35m loan.

For almost two decades the billionaire, 64, has been one of the leading players in Britain’s retail sector, purchasing Topshop owner Arcadia in 2002, and twice trying and failing to buy Marks & Spencer.

In often testy exchanges with MPs on the Work and Pensions committee, the billionaire tycoon insisted he had been the victim of “outrageous” and “rude” media claims about his business affairs.

‘We hope he will come up with an offer that is satisfactory to The Pension Regulator, ‘ they said.

Britain’s Insolvency Service and the Pensions Regulator are also investigating BHS’ collapse. Much of his reputation now depends on how generously he responds.

Sir Philip tried to interrupt, saying “I was having a joke with him, lighten up”, before Fuller finished with the question “Is that your usual pattern of behaviour, particularly with your directors?”