Slater & Gordon makes changes

The Australian firm has, however, said it will not be affected by this investigation.

Slater & Gordon shares closed up 17 cents, 5.76 per cent, to $3.12.

Looking to its 2015/16 financials the firm revealed it is expecting to generate A$1,150m, including revenues from SGS, which on current conversion rates would see them be among the world’s largest 100 law firms.

Shares of embattled legal eagle Slater & Gordon Limited (ASX: SGH) soared 20% higher to $3.56 this morning following the group’s full-year earnings release.

The EBITDA margin was 23.3%, down from 24.5% in the prior year, while the group’s net profit rose 7.7% to $70.7 million.

Short interest in Slater & Gordon has risen substantially since June 30 from 28 million shares to 51 million, or 15 per cent of the share-register.

Slater & Gordon said it was continuing to co-operate fully with ASIC as it concludes its review process, which is expected to be completed shortly.

Slater & Gordon managing director Andrew Grech said the results reflected the introduction of business improvement initiatives throughout the year.

Slater & Gordon will change one of its accounting policies as a result of the Australian Securities and Investment Commission’s probe into the company’s book-keeping, sources have told the Australian Financial Review.

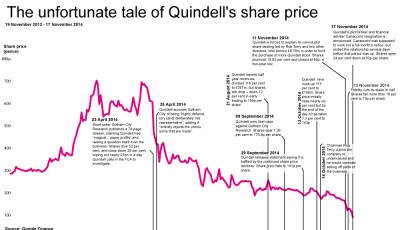

In their preliminary final report, the directors said: “On 5 August 2015, the Serious Fraud Office in the UK advised that it has opened a criminal investigation into the business and accounting practices of Quindell“. The underlying operational performance across Australia and the UK is strong and we have again delivered what we promised at both a strategic and operational level.

While VGI has asked questions about Slater & Gordon’s accounts, other short-selling hedge funds are betting that the company’s bold United Kingdom acquisition will destroy value.

Grech added: ‘The results are even more pleasing having regard to the intensive acquisition activity and additional scrutiny our team has had to contend with’.