Solera Getting Acquired By Vista Equity Partners

Vista will pay $55.85 a share in cash for the company, according to a PR Newswire statement. It is the largest in the history of Vista according to a Reuters report.

For Vista, this would be the private equity firm’s biggest acquisition ever, topping the $4.2 billion purchase of Tibco Software last year, Bloomberg said.

On PR Newswire, Solera announced its board of directors had formed a special committee to address the deal make by Vista as the company is looking for alternative options that are deemed beneficial for the company. Other investors include an affiliate of Koch Equity Development LLC and an affiliate of Goldman, Sachs & Co. The total valuation of the deal including Solera’s net debt is said to be worth $6.5 billion. Koch is to hold equity and preferred securities and the Goldman affiliate is to own preferred securities and hold debt. “For almost half a century, Solera has been serving the insurance and automotive industries with innovative software and information solutions”.

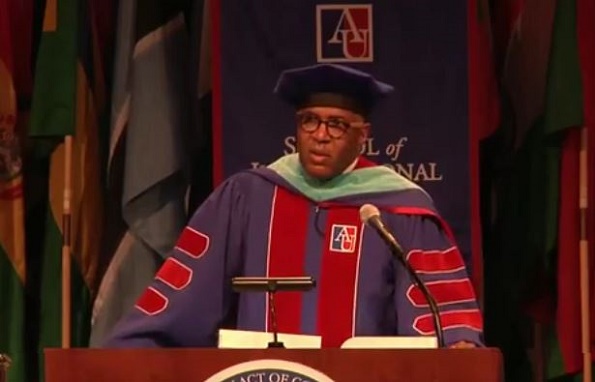

Robert F. Smith, the founder, chairman and CEO of Verizon Equity, adds in the press release that they are excited to be working together with Solera.

Vista is a private equity firm that is based in the United States.

Aquila founded Solera in 2005 and has been expanding the company by acquisition. The stock gained $4.21, or 8.5 percent, to close at $53.66.

Industry sources said then that there was unease with Solera’s story in the public markets, partly because of its aggressive push into new areas through acquisitions and investments, which have subsequently hurt the company’s margins.

These equity firms are attracted by the resilience of these insurance service providers in a downturn.

“With more than $14 billion in cumulative capital commitments, Vista seeks to partner with world-class management teams looking to reach their full potential”, according to the company’s website.

Officials with Solera, Vista Equity, Thoma Bravo, Blackstone and Pamplona did not return requests for comment Monday.

Solera said Sunday that the proposed merger had been unanimously approved by its board of directors and that it expected to close the deal no later than the first quarter of 2016.