‘Strong case for December interest-rate hike by US Fed’

“The markets are still quite euphoric on the increased prospects of Fed rate hike in December, which prompted bullish Dollars positioning”, said Bernard Aw, market strategist at IG in Singapore.

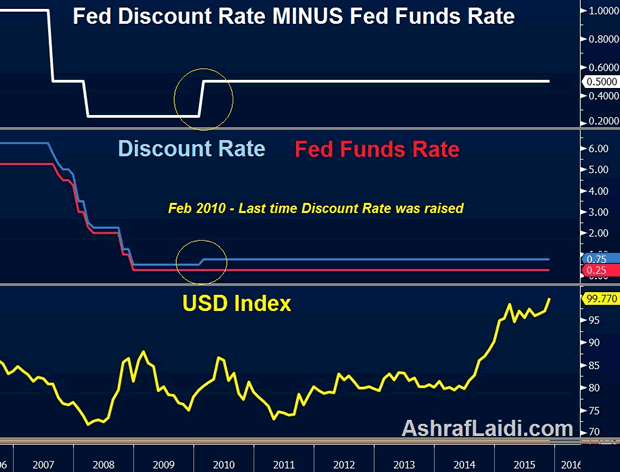

That’s a risk for markets if they get a little spooked that the Fed is going to move faster than now priced. Thursday’s post on the Federal Reserve’s website that “an expedited, unscheduled meeting of the Board of Governors of the Federal Reserve to review the discount rate” will be held today (Monday) at 11:30 ET (16:30 London/GMT).

In practice we suspect the pace of rate hikes will be guided by three factors: (1) the extent to which inflation appears to be returning to target, (2) how financial conditions respond to the first few rate hikes, and (3) whether growth remains above trend.

Jeffrey Lacker, president of the Fed’s Richmond bank, said in a CNBC interview on Wednesday that he believed that any economic impact from the terror attacks last week in Paris would be temporary.

We have argued, and the Fed’s Vice Chairman Fischer emphasized the point earlier this week, the Fed has done everything to avoid surprising the market with a rate hike.

Commodity markets were hit and stocks and bonds were in the firing line on Monday, as expectations for a first increase in USA interest rates in nearly a decade next month pushed the dollar to a seven-month high.

Similarly, the European Central Bank and People’s Bank of China have both made moves to reduce interest rates or pump more liquidity into the system.

The rate rise could come as long as USA economic data did not disappoint.

Higher rates tend to weigh on gold, as they lift the opportunity cost of holding non-yielding assets, while boosting the dollar. “There is a ceiling on how much more it can raise rates because of the appreciation of the dollar”, she said. The tighter monetary policy would diminish the supply of us dollars floating around in the economy and help the greenback appreciate against foreign currencies.

“With the futures market pricing in a close to 70 percent odds of a December rate action, Dollars strength is likely to persist”.

Ms Stupnytska is predicting a further two rate hikes next year, which will bring rates to just under 1 per cent by the end of next year.

This year has marked a change in the behavior of the Fed. If that is the case, my colleagues and I have indicated it will be appropriate to begin to normalize interest rates.

In its October 28 policy statement, the Fed said it would consider increasing the rate over the short term that has been pinned to zero since December of 2008.