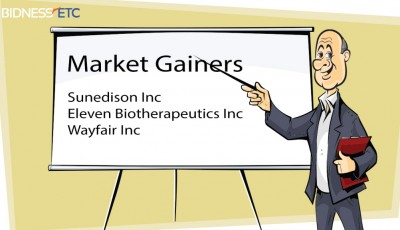

SunEdison, Goldman Sachs Fund To Form $1 Bln Warehouse Investment Vehicle

Sunedison Inc NYSE:SUNE (SunEdison) is a developer and seller of photovoltaic energy solutions, an owner and operator of clean power generation assets, and a developer and manufacturer of silicon wafers. The project is now under construction and fully financed with an expected commercial operation date of mid-2016. These statements involve estimates, expectations, projections, goals, assumptions, known and unknown risks, and uncertainties and typically include words or variation of words such as “expect”, “anticipate”, “believe”, “intend”, “plan”, “seek”, “estimate”, “predict”, “project”, “goal”, “guidance”, “outlook”, “objective”, “forecast”, “target”, “potential”, “continue”, “would”, “will”, “should”, “could”, or “may” or other comparable terms and phrases. What management didn’t talk much about on the conference call was the company’s continued losses, including $263 million last quarter alone. Morgan Stanley, Bank of America Corp. and Deutsche Bank AG are committing $700 million for the debt structuring through a $500 million five-year term loan… The total $650 million financing package fully funds the project for completion and long-term ownership. Sunedison has a 52-week low of $10.86 and a 52-week high of $33.45. SunEdison, a vertically integrated solar industry power and a leader among solar investments, has dropped 55% since July 20. Sunedison’s stock is down -39.53% in the last 200 days. Nevertheless, shares fell as a response to the company’s $263 million net loss, as investors were left concerned over SunEdison’s many new acquisitions. The stock is having its 200-day moving average of $1.88 and $1.38 as its 50-day moving average.

At the end of Friday’s trade, TerraForm Power Inc (NASDAQ:TERP)’s shares dipped -1.77% to $25.50. Around 28% of the company’s shares, which are float, are short sold. The company’s market cap is $3.38 billion. During the same quarter previous year , the firm earned $0.12 earnings per share.

Is this a Buying Opportunity? That could be a boon for shareholders if interest rates stay low but if they rise, as many predict, variable interest rates on debt could eat up most of SunEdison’s upside from these facilities and it’s unknown what the company would do with the assets then. Two analysts have rated the stock with a sell rating, two have issued a hold rating, fourteen have assigned a buy rating and one has given a strong buy rating to the stock. On a consensus basis this yields to a Buy rating.