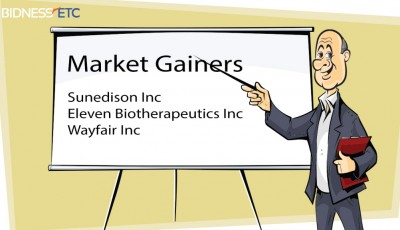

SunEdison teaming with Goldman Sachs on $1 billion investment facility

The company reported ($0.93) EPS for the quarter, missing the Zacks’ consensus estimate of ($0.55) by $0.38.

Separately, Credit Suisse reissued a buy rating on shares of Sunedison in a research report on Thursday.

Sunedison (NYSE:SUNE) had its price objective cut by Robert W. Baird from $35.00 to $20.00in a report published onWednesday, StockTargetPrices.com reports.

“We wouldn’t buy huge amounts, but because we are long-term investors we can be opportunistic”, said Amber Fairbanks, a portfolio manager with the firm.

TerraForm stock rose 1.3% Monday to 25.83, but it’s down nearly 40% from its all-time high of 42.66, touched in April. Around 28% of the company’s shares, which are float, are short sold.

The firm’s unit, TerraForm Power, will have the exclusive right to purchase power projects developed through the new fund, SunEdison said. The Insider selling transaction had a total value worth of $885,000. On Wednesday, shares fell to 11.78, the stock’s lowest price since December 2013. SNDK EPS growth in last 5 year was 18.80%.

Energy, Inc. (FANG) declared the pricing of an underwritten public offering of 2,500,000 shares of its common stock. SUNE stock price has underperformed the S&P 500 by 29.4%. Equities analysts anticipate that Sunedison will post ($2.98) earnings per share for the current fiscal year. The firm’s market capitalization is $4.24 billion. Although SunEdison believes its expectations and assumptions are reasonable, it can give no assurance that these expectations and assumptions will prove to have been correct and actual results may vary materially.

Diamondback Energy, Inc., an independent oil and natural gas company, focuses on the acquisition, development, exploration, and exploitation of onshore oil and natural gas reserves in the Permian Basin in West Texas.

SunEdison is a global renewable energy company that helps develop and build solar power plants and wind energy plants. The Companys Solar Energy segment includes the operations of its old Solar Materials segment, as well as its SunEdison business. In the Semiconductor Materials, the Company offers wafers with a variety of features. The Company’s wafers vary in size, surface features, composition, purity levels, crystal properties and electrical properties. In July 2014, the Company acquired 50% interest in Silver Ridge Power LLC (SRP) from a subsidiary of AES Corp.