“Super Thursday” prompts Sterling to slump

Inflation is projected to rise from current lows “around the turn of the year“, as past falls in energy prices drop out of the annual comparison, the report said.

“Given that Carney aims to return inflation to target within two years, the probability of a rate hike later this year has reduced”.

Ian McCafferty voted to increase Bank Rate by 25 basis points, given his view that demand growth and wage pressures were likely to be greater, and the margin of spare capacity smaller, than embodied in the Committee’s collective August projections.

Matthew Ryan, strategy analyst at Ebury, said: “A Bank of England rate hike in 2015 would provide strong support for sterling back towards the 1.60 level against the US dollar, and 1.50 versus the euro by year-end”.

This marks the first time the Bank of England has released MPC minutes alongside its rates decision.

“Short term interest rates have averaged around 4.5% since around the Bank’s inception three centuries ago”, said Carney in a speech on July 16.

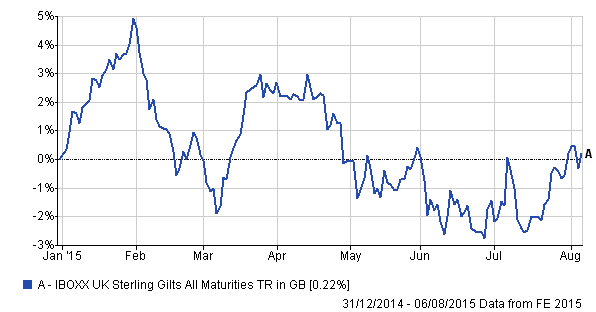

Analysts’ consensus is for the rate to begin rising early next year amid steady British economic growth, having remained unchanged since March 2009.

The Bank of England is the only one of the world’s 10 leading central banks that still publishes its rate decision without any accompanying explanation.

Although many economists were expecting two or three, rather than just one, MPC member to vote for higher rates, this is nonetheless the first meeting with a split vote since December.

For the US the debate is not indifferent with the Fed’s voting member Lockhart overnight calling for the start of rate hikes in September, but the market is expecting later in the year and we have two important nonfarm payrolls releases ahead of then, the first being on Friday.

The Bank forecasts that inflation will hover around zero for the next few months, with the potential for again turning negative as it did briefly earlier this year. Carney said the outlook is “consistent” with the need for interest-rate increases – but only in due course.

In a sign of how the debate on the MPC may develop, some of its members saw a risk that inflation could pick up more strongly than the central forecast, the BoE said. “The likely timing of the first bank rate increase is drawing closer”, he told a press conference.

Howard Archer, chief UK and European economist at IHS Global Insight, said the chances of an interest rate rise this year had “seemingly receded markedly”.