Supreme Court declines to review insider trading case

The rebuff is a blow to U.S. Attorney Preet Bharara, the New York prosecutor who had racked up more than 80 insider- trading convictions during a six-year attack on crooked fund managers, corporate insiders and consultants.

The United States Supreme Court’s decision Monday to not hear arguments in a high-profile insider-trading case could have widespread repercussions on Wall Street, including other convictions being overturned. The appeals court said there must be proof the defendants were aware that insiders who disclosed the confidential information had had received a tangible benefit for doing so.

The court said it will not hear the case of two hedge fund traders accused of illegally earning $72 million by acting on insider information that was not available to the general public. The ruling “insulates from liability deceptive acts that undermine the integrity of the markets”, U.S. Solicitor General Donald Verrilli argued in the government’s appeal. We could find out fairly soon in the Ninth Circuit case we have discussed previously, United States v. Salman. “We think there is a category of conduct that will go unpunished going forward”, he said.

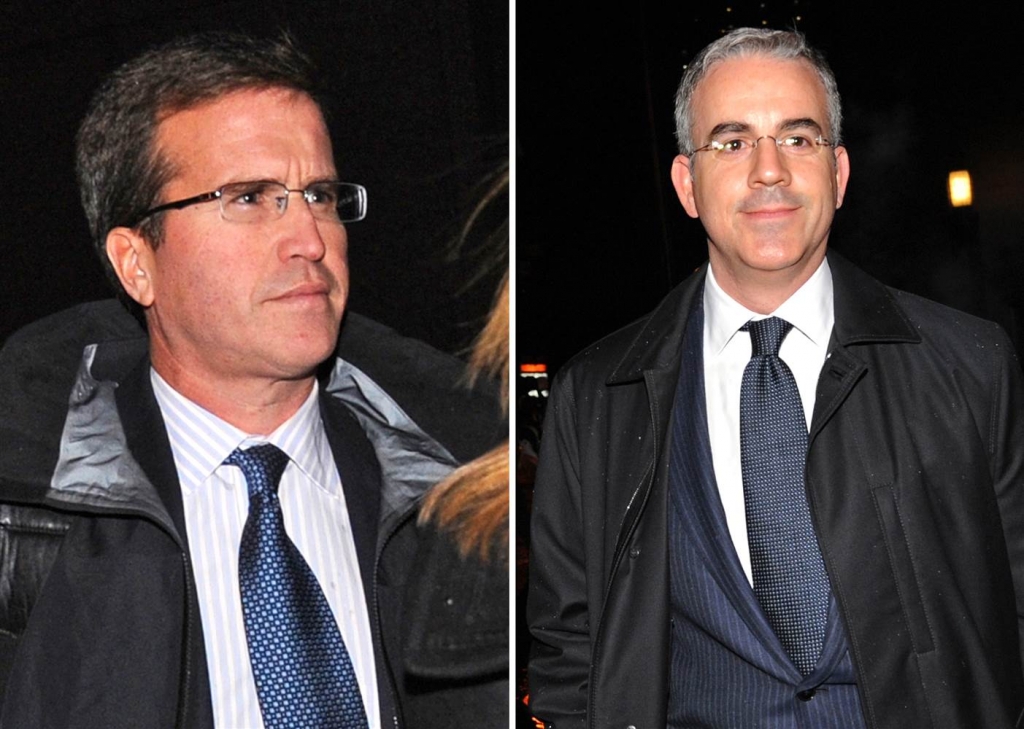

Newman, a former portfolio manager at Diamondback Capital Management, and Chiasson, a co-founder of Level Global Investors, were convicted in 2012.

The personal-benefit requirement evolved from the Supreme Court’s 1983 decision in Dirks v. S.E.C. The elements of fiduciary duty and exploitation of nonpublic information also exist when an insider makes a gift of confidential information to a trading relative or friend.

Prosecuting insider trading has been a top priority under Bharara, resulting in the conviction of Galleon Group hedge fund founder Raj Rajaratnam and a $US1.8 billion settlement and guilty plea by the hedge fund SAC Capital Advisors.

The Government also maintained that Newman conflicts with decisions of other Courts of Appeals, including the Ninth and the Seventh Circuits. The defendants, Newman and Chiasson, learned the information indirectly and said they did not know enough about the original tips to be held criminally responsible for trading on them.

– Turned away an appeal from Kelly Rindfleisch, a former aide to Wisconsin Gov. Scott Walker who was convicted of campaigning on taxpayers’ time.

WASHINGTON _ The Supreme Court let stand a major insider-trading ruling that threatens at least 10 convictions and creates what the Obama administration calls a road map for securities fraud.

Newman and Chiasson invested on helpful hints they can comes from their own team members observers, that have been convicted of checking supply consult an entire network of observers and company shareholders and subsequently conveying these items on to their ealier…

That court also narrowly defined what constituted a benefit to the tipper by saying it could not be just be a friendship but had to be of “some outcome”.

Part of us mourns that the Supremes didn’t take the opportunity to clarify the insider-trading laws that have become a fount of prosecutorial mischief. But…