Supreme Court’s sales tax decision will benefit small, local businesses

South Dakota is a “great victory for consumers and retailers”. “Our 4,200 retail members and our association have advocated for this decision for more than two decades”. “The retail industry is changing, and the Supreme Court has acted correctly in recognizing that it’s time for outdated sales tax policies to change as well”.

Quill is a precedent that traditional retailers have sought to overturn for 20 years – because they believe it gives e-commerce sellers an unfair price advantage.

Brick-and-mortar retailers are also celebrating the news. Legislative action has been stalled while the Supreme Court was deciding this case. Customers were generally supposed to pay the tax to the state themselves if they don’t get charged it, but the vast majority didn’t. “Whether you’re an online retailer or a brick-and-mortar retailer, you should have the same legal standards apply for you with respect to taxation, and that’s really what this decision is about”. The law that sparked this challenge passed in South Dakota in 2016. Henchman thinks the real figure is about half that, based on his analysis of states’ experience as they have succeeded in taxing a larger fraction of online sales over the last few years. The results were published in the April 1 issue of BRAIN. Kennedy said that position was archaic, “unsound and incorrect” in the internet age.

Ultimately, the decision may prod Congress to act. North Dakota puts businesses that have a physical presence within state boundaries “at a competitive disadvantage”. In a note Thursday, Goldman Sachs analyst Blake Taylor said that most major retailers already pay sales taxes online and states may be slow to pursue the small number of retailers that do not yet do so.

The bill, however, had no teeth until Thursday, when the Supreme Court ruled. That will open the door to more states passing laws similar to South Dakota’s.

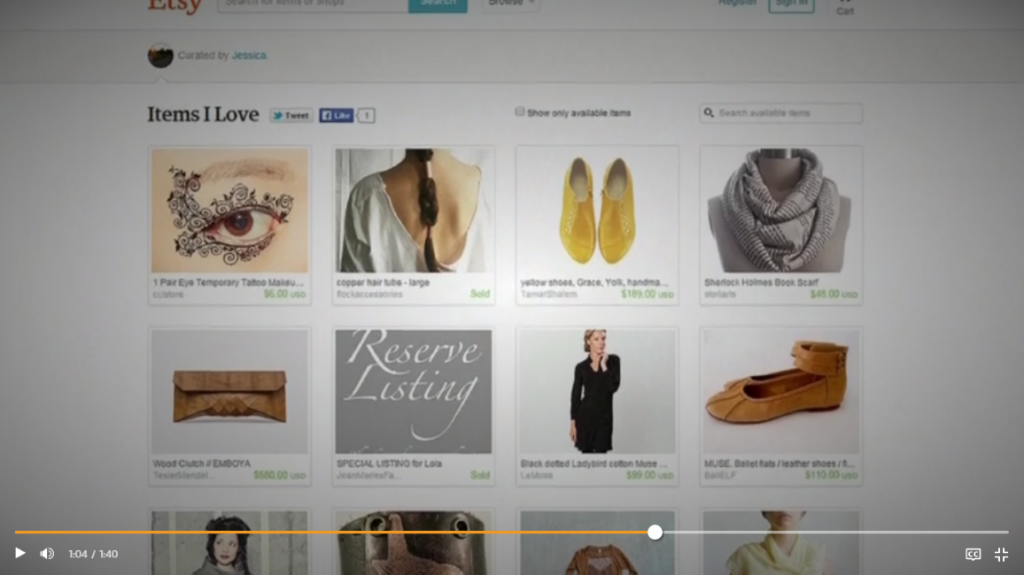

While a small business in, say, South Dakota probably won’t be selling me a auto, they would have to know what those other tax rates are, charge me accordingly if I were to buy something from them and then file a report to the state. Physical stores have always had to charge sales tax, but many online retailers have been able to undercut them by ignoring sales tax.

States were eager to collect the estimated .4 billion in annual revenue they could potentially glean from charging online sales taxes.

But for large retail chains that operate stores, the benefits are likely to be limited, according to tax and retail consultants.