Swipe left: Online dating company Match to go public

Love is finally going to be available on the public market. Match Group’s Securities and Exchange Commission filing notes a goal of raising $100 million through the IPO, though such figures are typically revised before the company begins trading. All, of course, are geared toward fulfilling a mission to “increase romantic connectivity worldwide”. The apps generate revenue through fees for special features and subscriptions, with about 4.7 million paying members across the portfolio as of September 30.

In 2014, Match Group had sales of almost $900 million and earned $240 million in profit. In the last two years the Match Group has seen an increase in revenue of 13 percent from 2012 to 2013, and then another 11 percent increase in revenue year over year from 2013 to 2014.

IAC also owns many other popular websites and apps – including Vimeo, The Daily Beast, About.com and search engine Ask – which many still remember as the old Ask Jeeves.

Market leader Match competes with No. 2 eHarmony and companies such as Zoosk and Spark Networks, which owns JDate and ChristianMingle, in the more than $2 billion-a-year US online dating market. Match Group’s products are in 38 languages across more than 190 countries, the company said in its S-1 filing. Other unknown or unpredictable factors that could also adversely affect our business, financial condition and results of operations may arise from time to time.

Here’s the US Securities and Exchange Commission filing.

“As long as IAC owns shares of Class B common stock representing a majority of the total voting power of our outstanding capital stock, it will be able to control any corporate action that requires a stockholder vote, regardless of the vote of any other stockholder”. Before the end of the year it expects to buy yet another site, PlentyOfFish, for $575 million.

The company is listing under the Nasdaq as MTCH, with the IPO being led by JP Morgan, Allen & Company, and Bank of America Merrill Lynch.

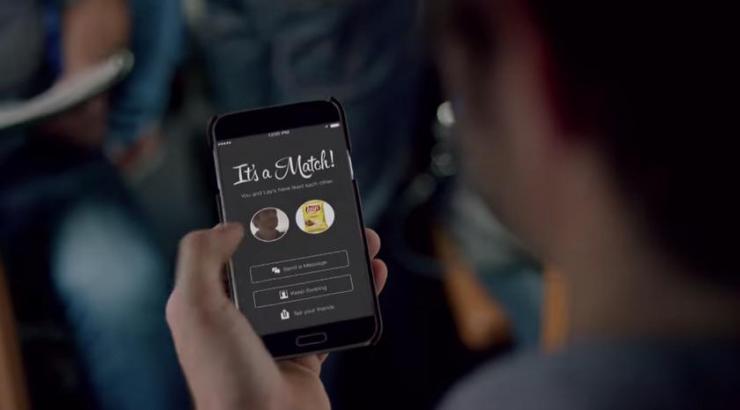

Would you swipe left or right on Tinder stock?