TD Ameritrade: Investors Should Have More Clarity After Fed Meets

In the absence of major economic releases out of the USA, the focus is turning to the Fed which starts its two-day monetary policy meeting today. 2008.The yield rose 2.9 points in expectation of a rate rise from the Fed this week.

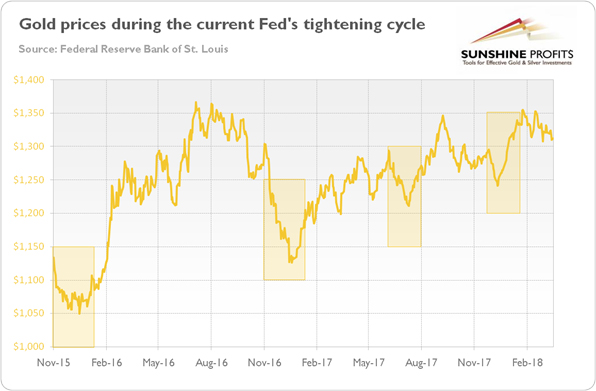

Gold prices have tended to fall ahead of Fed rate increases in recent years and to rise after them. The FOMC is nearly unanimously expected to raise interest rates at this week’s meeting.

WTI crude and Brent crude each added more than $1 on Friday, almost a 2% jump, for the second straight weekly gain for the oil market.

The bigger question, however, is what will the Fed do next? Investors are also awaiting the first Federal Reserve meeting under the new chairman, Jerome Powell, and anticipating the first rate increase of the year.

This week Fed Chairman Jerome Powell will oversee his first FOMC meeting. We expect Powell’s communications to focus less than Yellen’s on detailed labor market conditions with which she was more comfortable, and more toward overall economic performance and the Fed’s role in supporting sustained expansion. With stocks on edge last month, Powell told lawmakers his outlook for the United States economy had “strengthened since December”. We’ve seen some data that will, in my case, add some confidence to my view that inflation is moving up to target. More aggressive rate increases would likely slow the economy and make stocks less appealing.

“In line with its policy tack of gradual rate hikes, the Fed will likely adjust the pace of rate rises after it becomes more confident about inflation”.

Some policymakers also worry the tax cuts could stoke risky investments that could tip the economy into another downturn.

Potential concerns about the economy or a mention of the lack of progress in the core PCE index – the Fed’s preferred measure of inflation – on the other hand, could weaken the greenback. This was the lowest score since September 2016 and well below the expected level of 13.0. The Economic and Statistic Group (ESR) of the GSE is, in fact, expecting at least three rate hikes this year. This runs the risk of having the economy overheat and of thereby having the Fed lose control over inflation.

“There has been the narrative of supposed policy convergence between the ECB and the Fed, but that is just not the reality”, said Saxo Bank’s head of FX strategy John Hardy.

In the U.S., Facebook tumbled 6.8 percent on Monday as the social media colossus faced demands for action from U.S. and European lawmakers following reports that a consultancy that worked on President Donald Trump’s election campaign may have improperly gained improper access to data on 50 million Facebook users.

Wall Street look set to lose more ground when NY reopens having seen the Dow .DJI lose 1.57 percent last week, the S&P .SPX drop 1.04 percent and the Nasdaq .IXIC 1.27 percent. US joblessness hasn’t been that at that level since the Korean War, and no one is quite sure what that could do to inflation or financial stability. Even the dovish Fed Governor Lael Brainard noted recently that the economy’s “headwinds are shifting to tailwinds”.

Should the Fed raise interest rates as is widely expected, the federal funds rate would hover above South Korea’s benchmark rate, with the gap likely to gather pace in the coming months. For now, though, the Fed has little reason to dramatically modify its plans.