Trian becomes a top GE investor

Nelson Peltz’s Trian Fund Management, has become a top ten shareholder of General Electric Co (GE) with a beneficial ownership of 98.5 million shares now valued at approximately $2.5 billion. That, in a large part, is due to stricter federal oversight by federal regulators in the wake of the financial crisis. ( GE ) with a $2.5 billion stake. The private company based in Boca Raton, Florida, will get a portfolio of loans and leases, more than 300 aircraft and a team of GE employees.

He often publishes so-called white papers to coincide with his investment, and has written one on GE called “Transformation Underway…”

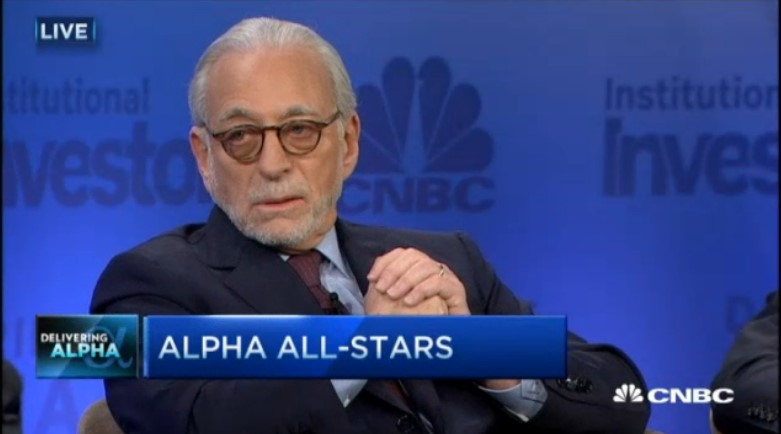

Nelson Peltz, chief executive officer and a founding partner of Trian, said, “We invested in GE because it is undervalued and under appreciated by the market despite what we believe is a transformation that will allow its world-class industrial businesses to drive attractive shareowner returns”.

In a report, Trian pointed to GE’s “stagnant” share price, with total shareholder returns climbing only 10 percent in the past decade, trailing industrial peers, with the stock hurt by GE’s dependence on its finance arm.

Over the past couple of years, Peltz has targeted DuPont and PepsiCo Inc, among others, demanding board seats and asking for separation of the companies’ fast-growing businesses from stagnating ones. In June, Trian took a stake in the water and fluid-products systems company Pentair and pushed it to consider acquisitions.

Immelt says GE is looking forward to constructive dialogue with Trian as it moves ahead with its transformation.

General Electric shares rose $1.05, or 4.1 percent, to $26.52 in premarket trading Monday about two hours before the market open.

In April, GE said it would try and sell a few $200 billion of GE Capital’s assets, putting the company on target to earn 90 percent of its profits from industrial operations by 2018.

GE said on Monday it was on track to complete $100 billion in GE Capital asset sales this year and achieve its raised industrial operating earnings forecast for 2015.