Trump proposes major tax cuts, 15% corporate rate

While Trump released his tax reform platform this week, the proposals are just the beginning of what will likely be a lengthy negotiation with both Republicans and Democrats in Congress.

US businesses would reap a windfall if President Donald Trump’s plan to cut corporate tax rates and slash taxes on cash parked overseas becomes law, but it was unclear whether they would stimulate a surge in investment and job creation in return.

When pressed with the fact that Trump’s plan would result in large tax reductions for rich people in general, and Donald Trump in particular, Mnuchin simply insisted, over and over, that the plan was not “about” that.

“There’s no question we should try to reduce (the corporate tax rate), but I don’t see how you pay for getting it down that low”, Casey said. This inheritance tax is levied on legacies worth more than $5.45m left after a person dies.

The proposed cut to corporation tax and income tax for the US’s highest earners, has caused outrage among some critics.

US President Donald Trump’s tax plan is skewed to benefit businesses and billionaires, rather than middle- and lower-class Americans. It would also repeal the estate tax and the alternative minimum tax, which could benefit wealthy taxpayers, including President Trump himself. Rather than simply focusing on cuts, which were emphasized by Cohn and Mnuchin Wednesday, White House budget mavens and members of Congress should be tackling more comprehensive reforms, according to Joe Kennedy, senior fellow at think tank Information Technology and Innovation Foundation and formerly chief economist at the Commerce Department during the George W. Bush and Barack Obama administrations.

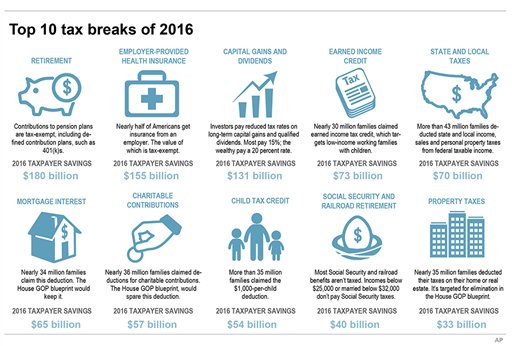

Trump would keep the popular deductions for mortgage interest and charitable giving but eliminate many others, including the deduction for state and local taxes. Instead of the current seven tax brackets, there would be only three – 10 percent, 25 percent and 35percent. But one thing is certain: “I would never ever bet against this president”.

And those criticisms could mean Republicans will be on their own when it comes to passing the biggest attempt at tax reform and tax cuts since Ronald Reagan did it more than 30 years ago. This change, the Financial Times’ Matt Klein points out, will hurt richer people more because they tend to live in high-tax states.

“Can you guarantee no one in the middle class is going to pay more?”

Tax cuts reducing them from 39.6 per cent to 15 per cent have been proposed by the USA leader’s administration. These are key Republican goals that would require lawmakers to eliminate or reduce precious tax breaks enjoyed by millions of Americans.

As for the negatives of the tax proposals, there is concern the plan raises the deficit in the short-term.

The one-page proposal released Wednesday seems sure to benefit the president’s businesses.

In its analysis of the Trump plan, the Committee for a Responsible Federal Budget said “no achievable amount of economic growth could finance it” and it would drive the debt to 111 percent of the gross domestic product by 2027, compared with 77 percent now.

Republicans call corporate tax cuts “pro-growth”, saying they will give the economy a boost.

REPORTER: When you talk about the individual tax rates you’re also talking about eliminating some of the taxbreaks.

On the corporate side, the top marginal tax rate would fall from 35 percent to 15 percent.

But most analysts agree that it is unlikely the proposed changes will make their way to Trump’s desk in their current form. They say “taxes take money out of the economy”.

The plan also includes a one-time tax on overseas profits.

White House officials already have said the top corporate tax rate would be reduced from 35 percent to 15 percent. This isn’t speculation. Kansas introduced such a pass-through loophole in its tax cuts package, and revenue hemorrhaged as individuals re-classified themselves as independent contractors, including University of Kansas men’s basketball head coach Bill Self.

The administration has said its tax cuts will spur growth, bringing in tax revenues to make up the difference, a calculation known as “dynamic scoring” which the Trump administration supports.