U.S. economy adds another 211000 jobs

Still, the second month of strong job gains should allay fears the economy has hit a soft patch, after reports showing tepid consumer spending in October and a slowdown in services industry growth in November.

The U.S. Department of Labor said today that there were job gains in construction, professional and technical services, and health care.

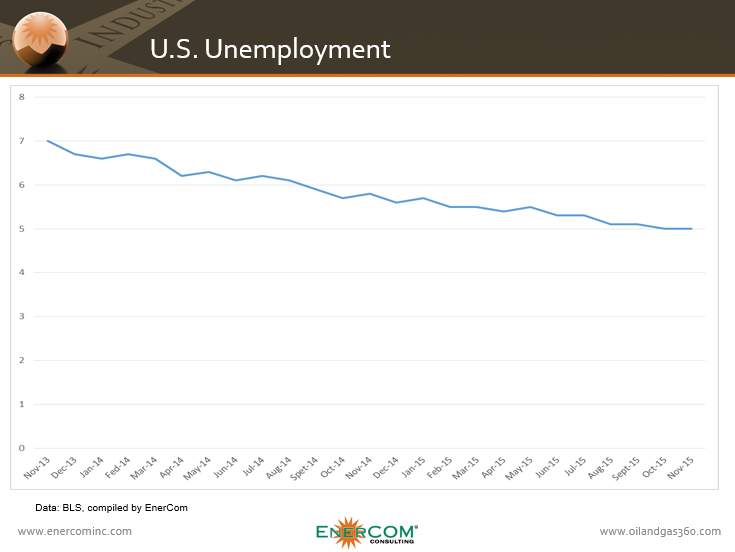

The stronger-than-expected numbers kept the unemployment rate steady at a seven-and-a-half year low of 5 percent as the upbeat outlook drove more Americans to try their luck on the job market. Hiring for September and October was revised higher by a combined 50,000 jobs. Yellen hasn’t quite come out and said explicitly that 100,000 new jobs is the green light for a December rate hike, but she’s dropped about as many hints as the Fed ever does about the future course of economic policy.

“Overall this confirms what Janet Yellen has called and keeps the Fed well on course to raise interest rates on 16 December”.

The robust figures could now pave the way for the first USA interest rate rise in close to 10 years later this month.

But the oil industry continues to be buffeted by low oil prices that have led companies to scale back drilling.

“We cleared the last hurdle for a rate increase”.

In addition, restaurants added 31,500 positions, retailers almost 31,000.

“The November jobs report showed another strong month of job gains, along with upward revisions to prior months”, said National Association of Federal Credit Unions Chief Economist Curt Long.

The differences among Fed policymakers were on display at a Philadelphia Federal Reserve conference on Friday where Narayana Kocherlakota, in his last speech as president of the Minneapolis Fed, gave a sharp critique of a central bank that he said was too anxious to begin raising rates and thus would fail to create perhaps millions of jobs in a timely manner.

“The employment report was the final nail in the coffin that we’re going to see a rate rise”, JJ Kinahan, chief strategist at TD Ameritrade, said.

Other data reported a small increase in first-time applications for unemployment benefits last week, but planned job cuts announced by companies in November were the fewest in 14 months.

Average hourly employee earnings rose by $0.04 or 0.2 percent to $25.25 in November after climbing by $0.09 in September. The participation rate of men and women between 25 and 54 years old is now 80.8 percent, exactly the same level it was a year ago but 2.2 points lower than it was before the Great Recession.

The information sector lost 12,000 jobs over the month. Factories shed 1,000 jobs. This was far below market forecasts of at least 200,000 added jobs.

The mining sector, which has been pummeled by low oil prices, fell by 11,000 last month, and has fallen by 123,000 over the past year.