U.S. Foreclosure Declined In First Half of 2015 : Finance & Mortgage

Irvine-based RealtyTrac’s U.S. Foreclosure Market Report showed Riverside County ranked No. 4 in statewide foreclosure filings during the first half of 2015. The report is being released Thursday.

Nationwide, foreclosure starts were down by 4 percent over the year and by 18 percent from 2006.

That was partly offset by a 27-percent increase in scheduled foreclosure auctions, which rose to 188.

But banks repossessed 1,927 residential properties in the three-county region during January-June period this year, compared with just 58 homes in the 2006 time frame.

Nationally, about one in every 221 homes is in some state of foreclosure.

Foreclosure activity throughout Florida dropped 22 percent in the first half of 2015 from a year ago, but the state still posted the nation’s highest foreclosure rate, with one in every 95 homes with a foreclosure filing this year. That was down 60 percent from a year ago when there were 15 such properties.

Foreclosure starts in the first half of 2015 were at or below their pre-crisis levels of 2006 in 19 states, including California, Florida, Arizona, Georgia and Illinois, the report says. “Although it’s been a long recovery, the bad loans and bank-owned properties are winding their way through the long process”, said Mark Hughes, chief operating officer with First Team Real Estate, covering the Southern California market. “However, our current robust market has muted the remnant…” Meanwhile, foreclosure starts for June tracked at 49,105 properties, posted a 4 percent decrease from May, but 4 percent higher than past year.

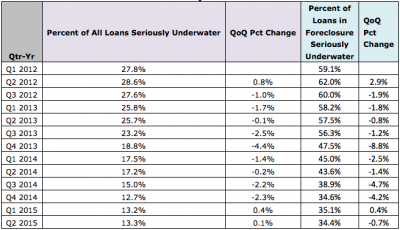

The housing bubble may have burst years ago, but there are signs the U.S.is still feeling the effects.

Atlantic City, New Jersey’s financially distressed gambling hub, experienced the top metro foreclosure rate in the first half, with a foreclosure filing for 1.70 percent of housing units, or one in every 59. These states includes California, Florida, Arizona, Illinois and Nevada.

Special methodology note on REOsIn the first quarter of 2015, RealtyTrac started receiving REO data from a new source that provides the data more quickly in some cases than other sources. The average number of foreclosure timelines also hit new high levels, stated RealtyTrac, posting an average of 629 days to complete the foreclosure process.

Lenders repossessed 36,503 USA properties in June, down 19 percent from the previous month but still up 36 percent from a year ago – the fourth consecutive month with a year-over-year increase in REOs and above the pre-crisis average of 23,000 a month in 2005 and 2006.

And the third state on the list, Maryland, had the same rate as New Jersey with one in every 109 homes, but that state’s rate isn’t increasing.