UK Budget 2015: the experts analysis

A new “National Living Wage” would be introduced for people aged over 25, coming in at £7.20 in April and rising to £9 to 2020.

“It is a part of saying to our country that we have got to have a better contract”, he told the BBC Radio 4 Today programme.

To do so, he has focused Government policy on making cuts to spending and changes to some types of tax relief, such as IHT and pensions.

“That is why I am determined to run that surplus, to have that economic security for families, to have that highly-competitive business environment so jobs are created”.

The Office of Budget Responsibility is forecasting the new living wage – Mr Osborne’s retort to criticisms he was not helping working people – will lead to 60,000 fewer jobs.

Fuel duty was frozen and the Chancellor announced a new banding system for road tax.

“It will really hit working families hard”. But he said the cuts to welfare were so large many people would be worse off. “The figures do not add up”, he said.

It added that an increase in the minimum wage, called ‘The National Living Wage’ by Mr Osborne, will not make up for majority of losses that will be experienced by those who receive tax credits.

“There was a little bit of everything for everyone, which was quite nice”.

The Institute for Fiscal Studies think-tank is set to unveil its own Budget analysis. The income threshold for tax credits has also been cut from £6,420 to £3,850.

Benefits cap to be reduced from £26,000 per household to £23,000 in London and £20,000 in the rest of the country.

“I am concerned about the effects that ending housing benefit for 18 to 21-year-olds which will have huge consequences”.

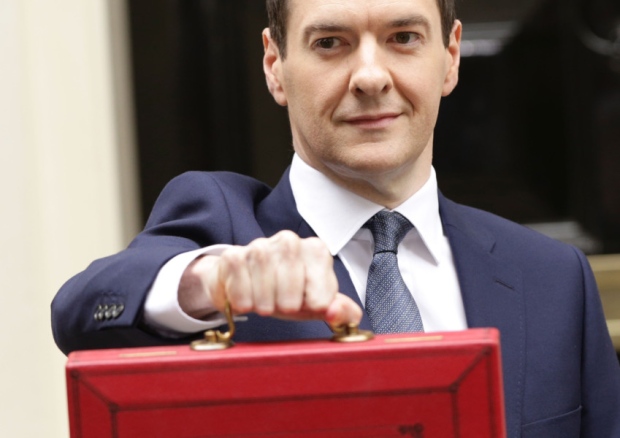

George Osborne stunned Labour and business yesterday by unveiling plans for a £9-an-hour compulsory “living wage”.

They assure us they won’t, but we’re not so sure because there’s a LOT of low emission cars that will soon pay £140 a year in VED.

“People on low and middle incomes will pay the price for the Chancellor’s choices”.

“That is the new settlement”. “And so there are those who say we do not need to do more”.

The Confederation of British Industry’s director-general John Cridland said that people working in restaurants, care homes and small shops would be most vulnerable as firms sought to rebalance their books.

“A budget for working people?”

Once upon a time, not so long ago, the Tories opposed a low minimum wage because it would cost jobs. It is a gamble.

There was also concern that the rise in the minimum wage would encourage European Union migration to the United Kingdom and undermine the goal of David Cameron’s key European Union renegotiation objective – giving Britain the right to bar European Union migrants from receiving tax credits for four years.

“Setting the minimum wage isn’t about morality”.

“Cuts to benefits will do nothing to improve many people’s situation in the poorest areas, if they start falling into debt on rent etc that will mean the burden will fall on local councils to cope. Now that is being prejudged by politicians to achieve a social objective”. However, the changes will be aimed at increasing tax on businesses which incorporate and then pay dividends rather than salary to the owners, which has historically often been a cheaper method of extracting profits from a company. Instead they will have to take out another student loan of up to £8,200 per year to pay for their living costs.