UK Growth Confirmed At 0.7%

Andrew Sentance, senior economic adviser at PwC, said: “Looking back over the recovery more broadly, upward revisions to GDP in earlier years mean that growth has averaged just over 2 per cent in the six years since the economy started growing again in mid-2009”. The energy sector, which grew 2% in July, will drive third quarter growth in Canada, he said.

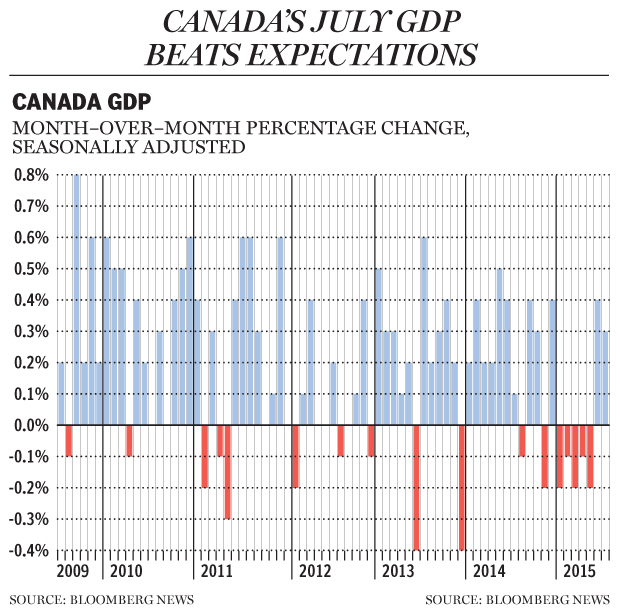

Statistics Canada reported on Wednesday that real gross domestic product (GDP) grew by 0.3 percent in July, exceeding the 0.2 percent growth forecast in a Reuters survey of economists.

Figuring prominently in July’s growth was a 4.4 percent rise in oil and gas extraction after a 2.9 percent increase in June. “However, given where prices are, and the significant slowdown in the energy sector, further meaningful gains aren’t particularly likely”.

Conservative Finance Minister Joe Oliver touted his government’s plan.

This morning’s reading on how Canada’s economy fared in July promises to be fresh fodder on the federal campaign trail.

“What it signals is, clearly, we are on the move”.

And to top if off the latest GDP revisions by the ONS reveal that British economic output is now 5.9 per cent higher than before the financial crisis, compared to initial estimates of 5.2 per cent. The ONS also confirmed UK GDP growth of 0.7 per cent for the second quarter.

Output expanded 0.3 per cent to an annualized $1.66-trillion, Statistics Canada said Wednesday in Ottawa. “A few years ago when we had these periods of the Canadian dollar going lower, the effect was immediate and very significant”, he said, adding that “with the Canadian dollar staying low for the foreseeable future, this is very positive for us”. The weaker currency makes Canadian goods cheaper in the US, which buys three-quarters of its northern neighbor’s exports. “And that’s an encouraging sign”, Reitzes said. “There’s a lot of runway on the manufacturing front”. Non-conventional oil extraction continued to grow in July after increasing 7.0 per cent in June, following maintenance shutdowns and production difficulties in April and May. The oil, gas, mining and quarrying category had recorded seven straight monthly declines through May.