United Kingdom inflation stays below zero

The U.S. Consumer Price Index (CPI) for all urban consumers increased 0.2 percent in October on a seasonally adjusted basis, in line with market consensus, the Labor Department reported Tuesday. It follows a rise in prices at the end of past year, which saw inflation on wine rise by 3.4%, which meant British wine drinkers did not feel the benefits of a then 0.5% drop in inflation.

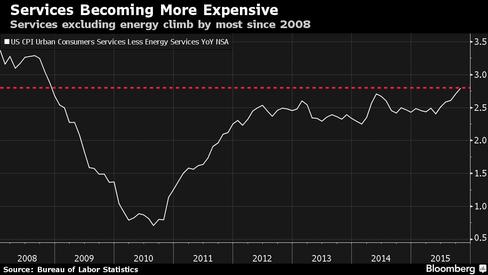

Energy prices have fallen by 17.1 percent over the last 12 months. The cost for food, energy, and all items except for food and energy, (the so-called core rate of inflation, since food and energy are volatile) all increased modestly in October.

Medical care services absolutely soared up 0.8% for the month and have increased 3.0% for the year.

The Fed’s preferred measure of inflation, personal consumption expenditures, has less of an emphasis on housing costs and has risen just 0.2 percent from a year ago. But grocery shoppers paid more for bread, bacon, chicken, turkey and fruits and vegetables increased last month. That acceleration followed several years of aggressive Fed easing (2001-2004), and it prompted a subsequent tightening, in which raised the Fed raised its target rate from 1% to 5.25%.

Yesterday NS&I cut the interest rate on their Cash ISA to its lowest ever level, a reminder that although the economy looks in decent shape, cash savers are still bearing the brunt of ultra-loose monetary policy, and things may yet get worse before they get better’.

Falling transport and food prices weighed down the rate, which has been far from the Bank of England’s 2% target. Over Jan-Oct the CPI grew by 3.7% year-on-year.

‘October’s -0.1 per cent rate of CPI inflation could be the last we see of deflation for now.

A report from the Fed showed manufacturing production increased 0.4 percent as the output of both long-lasting and nondurable goods rose.

As energy stops being a drag on consumer prices, overall inflation likely will ramp up quickly, giving Fed policymakers reason to act soon.

Medical costs rose once again from September.

So “core” consumer prices aren’t as weak as the headline index.

The CPI for other bakery products in October was 268.2, up 0.4% from September and up 1.2% from October 2014. Hospital costs increased 2 per cent.

While prices for clothing and recreational goods rose, these were offset by lower food, fuel, university fees, alcohol and tobacco.

Airline fares rose 1.5 per cent, ending a string of three consecutive declines, but apparel prices recorded their biggest decline since December.