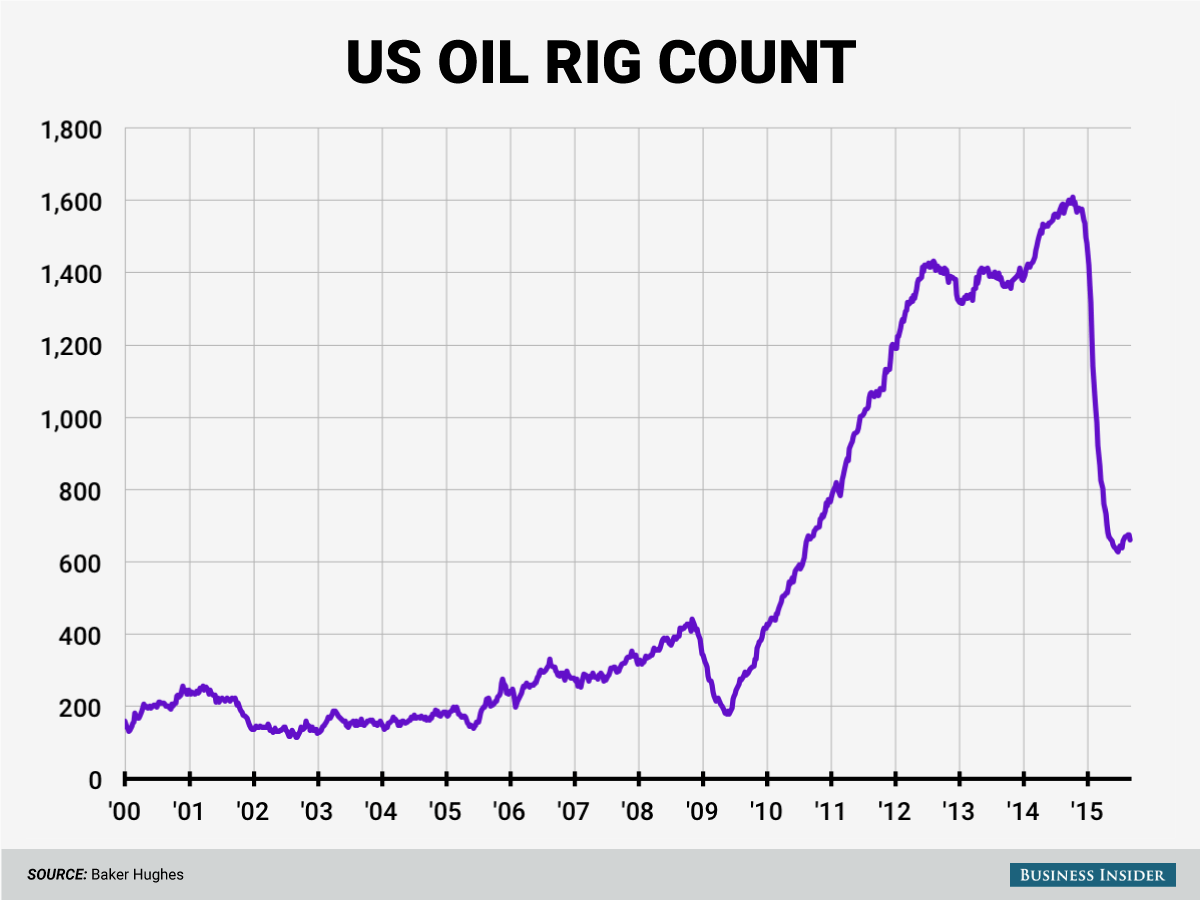

US drilling rig count falls again this week

Baker Hughes Incorporated (NYSE:BHI) now has an ABR of 1.91 based on 19 research analysts providing projections.

Drillers idled 10 oil rigs to bring the total number to 652, the fewest rigs in the field since the week of June 17. Baker Hughes Incorporated has lost 1.94% in the last five trading days and dropped 6.42% in the last 4 weeks.

Baker Hughes Incorporated (NYSE:BHI) most recently announced a dividend payout of $0.17 per share to shareholders of record on 2015-09-02, payable on 2015-09-23. The company’s stock had a trading volume of 2,390,358 shares. The firm has a market cap of $22.96 billion and a PE ratio of 88.24. The company earned $3.97 billion during the quarter, compared to analysts’ expectations of $3.88 billion. Equities analysts forecast that Baker Hughes will post ($0.30) EPS for the current year. During the same period in the prior year, the company earned $0.92 earnings per share. A year ago, with oil prices about double the prices now, 1,931 rigs were active. The total value of the transaction was worth $1,027,907. The 52-week low of the share price is at $44.11.

In total, brokerage analysts polled by Zack’s have a consensus target price of $74.263 on the name.

At the top of the hour, this week’s tally of U.S. oil and gas rigs will be released by driller Baker Hughes. Traders would be closely watching the weekend data coming out of the world’s second largest economy with regards to retail sales and industrial production which would provide an insight into the extent of slowdown in the Chinese economy. It runs its operations through affiliates subsidiaries, ventures and alliances. The Company operates in five segments: North America, Latin America, Europe/Africa/Russia Caspian, Middle East/Asia Pacific and Industrial Services.

Baker Hughes Incorporated (Baker Hughes) is engaged in the oilfield services industry.