US oil and natural gas rig count increases by 1 to 863

At around 1:00 p.m. ET on Friday, Baker Hughes will release the latest tally of oil and gas rigs, which could show only the second rise in the oil rig count this year, and a rise in the combined count for the second week in a row.

Both Halliburton and Baker Hughes expect to certify substantial compliance with the DOJ’s second requests, issued to each company, by mid-summer. The companies said they expect to achieve substantial compliance by midsummer.

Halliburton said in November that it was ready to divest businesses that generate revenue of $7.5 billion. Halliburton has a lot riding on the review. But antitrust experts have said the merger could face regulatory resistance because it would leave the industry highly concentrated between two large companies: the merged Halliburton, as the new company would be named, and Schlumberger Ltd.

The sideways price pattern around that Fibonacci level of $60.11 between May 5 and June 24 was almost strong enough to establish a “golden cross” for oil.

Shares of Halliburton increased less than 1% in recent after-hours trading.

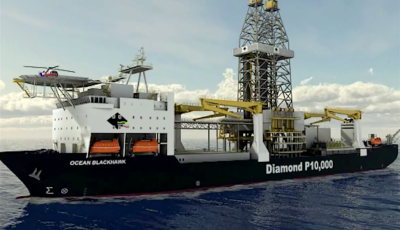

Oil and gas drilling and exploration companies have tanked year to date, including Diamond Offshore Drilling (DO – Get Report), down 31.6%; Noble Corp.

Halliburton and Baker Hughes continue to be in discussions with the DOJ, the European Commission and other competition enforcement authorities with respect to the acquisition.

In March, both Halliburton and Baker Hughes stockholders showed an overwhelming response of almost 99% and 98% respectively, in favor of the merger.

Access Investor Kit for Halliburton Co.