US oil falls below $40 first time in six years

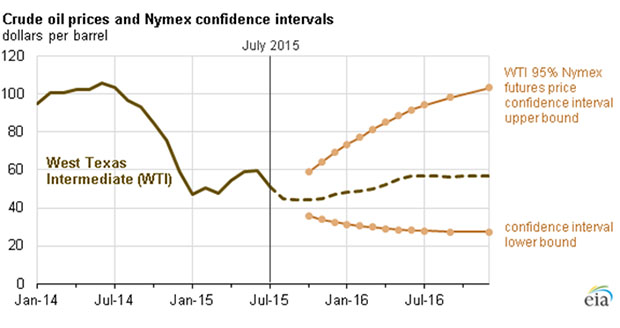

The U.S. benchmark hit 6-1/2 year lows near $40 a barrel on Wednesday and Brent crude for October delivery LCOc1 was down 29 cents at $46.33, after settling 54 cents lower in the previous session. Oil is down 34 percent from its high of $61.43 this year, and 62 percent from its high of $107.26 last year. However, there is no indication they will reverse their policy of keeping production wide open to defend market share, delegates told Reuters this week.

US crude inventories rose 2.6 million barrels last week to 456.21 million barrels, the government’s Energy Information Administration said.

Oil costs slid to a recent six and a half yr low in Asia Thursday, approaching the key United States dollars forty a barrel level after a shock rise in US inventories added to considerations of a provide glut.

Marathon Oil Corp. was the biggest loser on the S&P 500 index, suffering a 7.2-percent drop.

Demand growth is not keeping pace with supply, especially with the slowdown in China, the world’s top energy consuming nation and its second-biggest economy. All reached three- or four-year lows.

“Weighing on prices is the continued ample supply situation with crude oil builds in the U.S. and OPEC pumping at record levels”, Michael Poulsen, oil analyst at Global Risk Monitor, wrote in a report.

Spot prices of Western Canada Select (WCS), a marker for heavy, diluted bitumen from Alberta’s oil sands sank to a 12-year low near $20 per barrel.

At the RBI’s monetary policy review last earlier this month, Rajan said the fall in oil prices has been very beneficial for the country.

Analyst Thomas Pugh of Capital Economics said the main reason for the increase in inventories was refinery outages for maintenance and other issues.

A Japanese contraction, coupled with a series of crashes on the Chinese stock market sparked concerns some of the expected demand in oil may subside.

One of the reasons for the strength of the Indian rupee is the falling price of oil which has brought down the current account deficit, he said.

U.S. oil futures on Friday settled below $41 a barrel for the first time since the Great Recession to suffer an eighth straight weekly loss-the longest streak of weekly losses since 1986.

A further decline in oil prices is likely in the coming days as traders shy away from risky equities, soft global growth outlooks and weak US inflation data this week, Bell said.