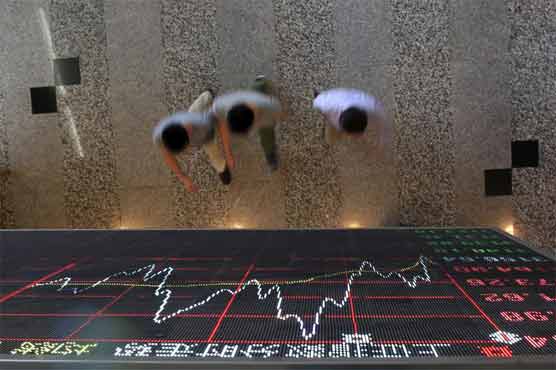

USA stocks drop in early trading on growth worries

On Wall Street, stocks ended mixed on Friday after athletic shoe giant Nike posted strong first-quarter income in greater China and Federal Reserve Chair Janet Yellen reassured that the US economy is stable enough to handle turmoil in emerging markets. The Nasdaq composite lost 143 points, or 3 percent, to 4,544.

European markets aren’t expected to be spared the selloff either. Commodity company Glencore dived 29 percent in London as investors increasingly doubt its financial strength in a time of weak commodity prices. Stocks in Southeast Asia were lower.

On Friday, the Standard & Poor’s 500 fell 0.9 points, or less than 0.1 percent, to 1,931.34.

Thursday will also see the Bank of Japan release its Tankan survey of business confidence, which provides key insights into Japan’s economic growth, corporate spending and investment plans. China’s industrial profits dropped 8.8 percent in August from a year earlier, the most in at least four years, rekindling worries about growth.

THE QUOTE: “Market sentiments continued to sour during the overnight session, with a host of factors being thrown as reasons behind the risk selling”, said Bernard Aw, market strategist at IG in Singapore. “Right now, we need evidence that China is not slowing that much and that profits are still going to be OK”.

China’s Shanghai Composite index is down around half a percent in the wake of soft industrial profits data. The sector – a recent favorite of investors – slumped last week after Democratic presidential candidate Hillary Rodman Clinton announced a plan to tackle rising drug costs.

Alcoa bucked the trend, gaining 3 percent after saying it would split in two. Its bauxite, aluminum and casting operations will be in one company and its engineering and transportation businesses will be in another.

On Wall Street on Monday, major indexes all closed sharply down.

Materials and mining companies had the biggest declines in midday trading Monday.

“We still don’t know when market fears will end about China’s slowdown, and because of this investors are turning to cash and safe assets”. The fallout from Volkswagen’s emissions rigging scandal is spreading to other auto brands.

In Europe, France’s CAC-40 slid 2.4 per cent to 4,373 while Germany’s DAX fell 1.7 per cent to 9,522. Australian shares dipped 0.1 per cent.

BONDS AND CURRENCIES: USA government bond prices rose, pushing the yield on the 10-year Treasury note down to 2.10 percent from 2.16 percent on Friday. Spot gold was little changed at $1,146.25 an ounce after dropping 0.7 percent on Friday. It fell $1.27 to close at $44.43 a barrel in New York on Monday.

ENERGY: Benchmark crude lost 1 cent to $44.42 in electronic trading on the New York Mercantile Exchange. Brent Crude, a benchmark for global oils, was up 2 cents to $48.03.