Valeant to cut drug prices at Walgreens

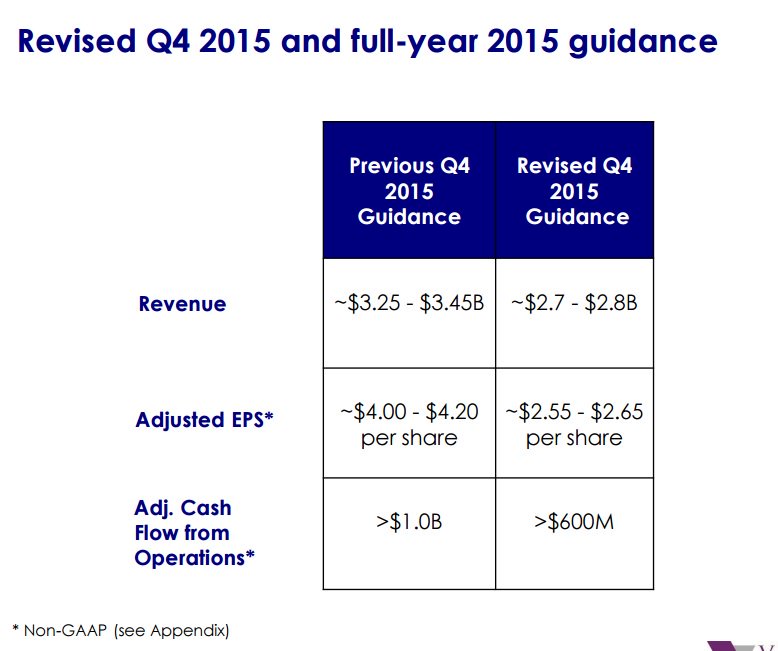

Valeant Pharmaceuticals International Inc. on Wednesday cut its revenue and profit guidance for the fourth quarter and the full year, ahead of its meeting with investors.

Shares for Valeant jumped 12% to reach $105.53 in morning trading.

Additionally, yesterday shares of the company soared after it announced a 20-year drug pricing and distribution agreement with pharmacy chain Walgreens Boots Alliance (WBA). Valeant is trying to make it clear that there is a difference between a single product company and a vast portfolio of products.

Valeant had been a highflier by taking over other drugs and drug firms and hiking drug prices, as opposed to the traditional pharmaceutical-industry growth method of discovering new drugs through research and development. Valeant said it would sever all ties with Philidor and has defended its accounting and distribution practices.

Stung by criticism that it jacked up the price of lifesaving medicines, Valeant Pharmaceuticals said Tuesday it will lower some prices through an agreement with Chicago-based Walgreens, the nation’s largest pharmacy retailer. For example, Valeant bought the life-saving heart drugs Nitropress and Isuprel in February, then tripled the price of one and raised the other sixfold. While we expect a degree of disruption to Valeant’s dermatology business, we believe that the fundamentals of Valeant’s overall business remain strong.

TRENTON, N.J. (AP) The ranking Democrat on a powerful congressional committee investigating soaring drug prices is turning up the heat on beleaguered Valeant Pharmaceuticals, demanding it supply previously requested and additional documents on questionable business practices. After the Philidor scandal, Valeant has been in the spotlight to take all the political risk but this move slightly shields it from that risk because of lower prices. Analysts have predicted earnings of $14.27 a share and $12.55 billion in sales, the Wall Street Journal reported.

Through increased traffic: Having Valeant’s branded products at the same price as the generic drugs will likely help drive traffic to Walgreens for these drugs.

For full year 2015, Valeant now expects adjusted EPS in the range of $10.23 -$10.33 compared to previous outlook of $11.67 – $11.87. On October 30, 2015, we held an investor conference call to answer the many questions we received about our investment in Valeant. Valeant will distribute the drugs directly to Walgreens instead of through a middleman, and pay Walgreens fees for filling prescriptions. “So that’s what we’re going to do”, Pearson said Wednesday.

Valeant said that the two programs will “provide up to $600 million in annual savings to the healthcare system”. JPMorgan Chase & Co. dropped their price objective on Valeant Pharmaceuticals Intl from $265.00 to $225.00 and set an “overweight” rating for the company in a report on Wednesday, November 11th.