Valeant-Walgreens Drug Discount Deal Opportunity for Valeant to Win Back Lost

Embattled Valeant Pharmaceuticals is slashing its expectations for the current quarter and 2015 as a whole and issuing a guarded outlook for next year as well.

Chief executive Michael Pearson and other Valeant executives will face questions from analysts at a company briefing this morning. One research analyst has rated the stock with a sell rating, eleven have assigned a hold rating, nineteen have issued a buy rating and one has assigned a strong buy rating to the company. Company officials declined to comment on the progress of that review.

Shares of Valeant, which is also facing multiple investigations over antitrust violations and drug pricing arrangements, were initially down during pre-market futures trading in NY, but rose up 0.8 percent at $110.50. The stock had soared past $260 to a new all-time high price as recently as August, but Valeant shares have largely plummeted since then.

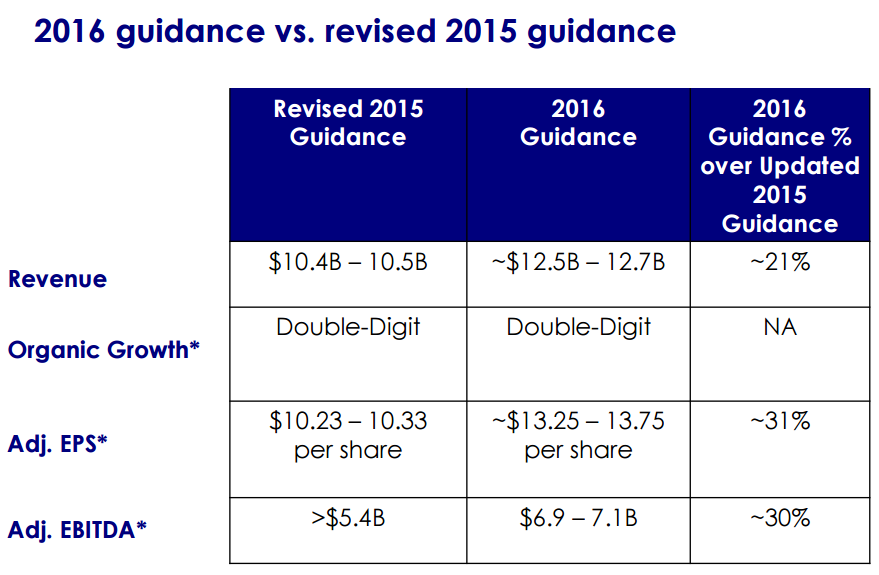

Morgan Stanley reissued their hold rating on shares of Valeant Pharmaceuticals Intl Inc (NYSE:VRX) in a report published on Tuesday, ARN reports. Analysts have predicted earnings of $14.27 a share and $12.55 billion in sales, the Wall Street Journal reported.

Investors will be listening for more details on the deal with Walgreens, the largest US drug store chain, and Valeant’s other plans on Wednesday, when it hosts an investor webcast to update its financial forecast and discuss business operations and research.

The sceptics have said that Valeant is a company that depends on aggressive acquisition accounting and price increases to show that it’s growing.

Pearson noted the company was the first to do a tax inversion, moving its official tax headquarters from the U.S.to Laval, Quebec, to reduce its tax rate, and that it now has the pharmaceutical industry’s lowest tax rate. The company stopped using Philidor in October, losing 20 percent of its dermatology prescriptions and $250 million in sales in the fourth quarter, he said.

“Next year, we’ll be about a $13 billion company”. We will make them as carefully and consistently as we can.

It says the price reductions under the 20-year agreement with Walgreens will be introduced in six to nine months. This new deal with Walgreens seems to work well for Valeant giving the company some credibility.

By-pass traditional pharmaceutical distribution systems:This will allow the company to cut cost by eliminating middlemen and by delivering drugs directly to Walgreens.

Shares of Valeant Pharmaceuticals International closed yesterday at $109.59, up $15.45 or 16.41%. The stock’s slide worsened when the Philidor allegations emerged, and shares hit a $69 low.

Democratic Congressman Elijah Cummings, a ranking member of the house Committee on Oversight and Government Reform, and Senator Bernie Sanders, a ranking member of the of the Subcommittee on Primary Health and Aging, Senate Committee on Health, Education, Labor and Pensions, are investigating the recent abrupt increases in drug prices.