Vietnam doubles currency trading band after China devalues yuan

The move to allow more flexible trading “could help maintain the flexibilty of the country’s monetary policy as cross-border financial flows increase“, S&P said.

The possibility that China’s move will trigger a beggar-thy-neighbor currency war.

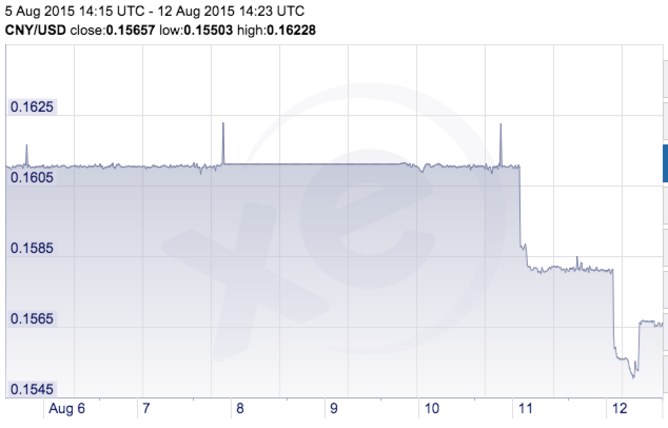

U.S. stock markets fell triple digits also for a second day in a row. China on Tuesday demeaned the yuan by one-.9%.

Growing doubts that the Federal Reserve will hike interest rates in September had knocked the greenback lower on Wednesday.

The yuan’s spot value fell further after Beijing released weak July output and investment data, trading as low as 6.4510 to the dollar.

The China Foreign Exchange Trade System – which operates the national foreign exchange market – and the central bank carry out a poll of market makers to set a daily reference rate, also known as the central parity rate.

More declines in the yuan are possible, as the central bank has said market forces will be given a bigger role in the future – something which policymakers in the US have long wanted. That exodus has held down the yuan’s value.

Or so Beijing says.

“If the market continues to push the RMB lower then it creates less purchasing power for Chinese importers, (then) any asset/company leveraged to the Chinese consumer/importer would be taking a hit now”.

Plenty of reasons. The surprise devaluation suggests that something is spooking the Chinese government.

The real issue is whether the financial panic will cause households to curtail spending and put the brakes on China’s GDP growth, which is already down to 6.5%, off from earlier forecasts of 8%. Signs of trouble are accumulating.

NO PARADE: Macy’s reporting a drop in quarterly profits and sales on Wednesday, as the department-store chain was hobbled by weak tourist spending and delays at West Coast ports.

The loonie rose to 77.01 US cents at mid-afternoon, after closing at 76.25 on Tuesday, a casualty of China’s decision to devalue its currency.

China’s central bank said on Thursday that there was no basis for further depreciation in the yuan given strong economic fundamentals, in a bid to reassure jittery global markets after it devalued the currency earlier in the week.

Meanwhile, China will extend the trading hours for the onshore yuan in a move to prompt the convergence of the onshore and offshore yuan market, said Zhang.

In the year up to mid-June, the Shanghai Composite Index shot up 150%, as Chinese investors hoping to make up for losses in a recent real estate downturn poured into the stock market, many of them for the first time.

The New Zealand dollar touched six-year lows, dropping almost half a cent against its American counterpart to US64.7 cents at one stage yesterday before rebounding. The Fed has kept the rate at zero since December 2008. He served as chief economist in the Office of worldwide Affairs at the U.S. Treasury from 2010 to 2011. That’s a result of consumers using more energy as prices drop.