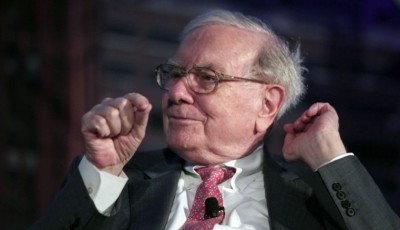

Warren Buffett closes in on his biggest deal ever

The company generates about half its annual sales of US$10 billion from big aircraft and engine makers. Precision Castparts embodies qualities that Buffett seeks, with high barriers to entry by competitors, a business that demands a long-term outlook, and a stock that has underperformed in recent years, said David Rolfe, who manages about $11 billion including Berkshire shares at Wedgewood Partners Inc.

And increasingly, Berkshire, whose market value stands at $354 billion, needs to strike enormous deals to continue growing its profits and revenue. Last year, 70 percent of the company’s sales were made from the aerospace industry and 17 percent from the energy market.

A deal could be announced as soon as next week.

Berkshire Hathaway already holds a three per cent stake in Precision Castparts, and it’s reported that a deal could be agreed upon within the week.

If completed at that price, the deal would surpass Berkshire Hathaway’s acquisition of the Burlington Northern Santa Fe railroad for about $27 billion in 2009.

Founded in 1949, the Portland, Oregon company makes components such as fasteners and turbine blades for aircraft companies including Airbus Group S.E. and Boeing Co.

Most recently, Berkshire Hathaway helped achieve the merger of Heinz and Kraft. In addition, Precision Castparts makes pipes and fitting for power and industrial companies.

News of the talks was reported earlier by The Wall Street Journal.

“That’s the real positive of the year, and that will come in the third quarter”, Kilpatrick said.

Neither Berkshire nor Precision Castparts returned calls and emails seeking comment.

Besides insurance and railroad companies, Berkshire owns utility, clothing, furniture, brick, carpet, jewelry and pilot training firms.

Buffett said last year that Berkshire’s future will be about buying big businesses and expanding them over time rather than picking stocks.

Though it started building its stake in the business in 2012, it is still one of Berkshire’s smaller investments, and these types of investments are usually picked by investment managers Ted Weschler and Todd Combs.

Now, the billionaire appears to be ready to fire that gun and claim his largest-ever acquisition.

A purchase would allow Berkshire to deploy a majority of its cash of more than $66.59 billion while leaving a cushion of $20 billion Buffett wants.