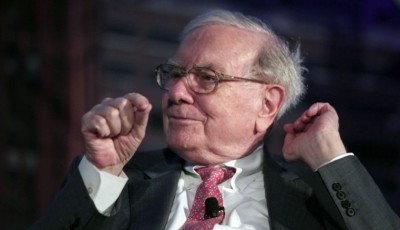

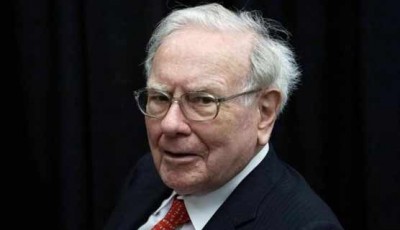

Warren Buffett reportedly close on latest big buy

The Buffett effect: Shares in airplane parts manufacturer Precision Castparts are rising by about 13% premarket on expectations that Warren Buffett’s firm Berkshire Hathaway is set to buy the company. Precision’s market value is now $26.7 billion as of the close of business on Friday.

The latest deal, which could be finalised this week, could be worth over $30bn, marking the biggest ever acquisition for the conglomerate, the Wall Street Journal reports.

The conglomerate controlled by the Omaha billionaire could agree the terms of a deal as early as this week, said one person, who cautioned that the transaction could still fall apart.

In February 2010, Buffett spent $26.5 billion in cash and stock for the 77.5 per cent he didn’t already own in Fort Worth, Texas-based railroad Burlington Northern Santa Fe.

Precision Castparts makes components such as nuts, bolts and other fasteners for aerospace companies such as Airbus and Boeing, an industry that accounts for roughly 70 percent of sales.

The company also manufactures products like pipes as well as fittings for industrial and power companies.

Precision Castparts has grown rapidly through a series of acquisitions, but its stock price has been weighed by a series of production problems, destocking by one of its largest customers and the exposure of its pipeline business to the oil and gas sector.

Buffett ranks those unglamorous companies among what he calls the “powerhouse five” non-insurance businesses whose combined earnings are a cornerstone of Berkshire Hathaway’s financial performance.

A deal would push Berkshire further into heavy industry and cut reliance on insurance and stock picking, growth engines for most of Buffett’s 50 years in charge.

Mr. Buffett has long said he’s seeking large acquisitions for Berkshire Hathaway, but often has bemoaned what he sees as the lack of targets at attractive prices. With annual revenues of almost $200 billion, Berkshire needs to make huge acquisitions to move the needle on earnings.

In 2013, it teamed up with hedge fund 3G Capital to acquire H.J. Heinz. As of March 30, Berkshire’s stake in the industrial company was valued at $814 million.

Precision Castparts and Berkshire Hathaway could not be reached for comment.

Though it began building that stake in 2012, it remains among the smaller investments in Berkshire’s portfolio.

Berkshire reported second-quarter results on Friday night that showed a 37 per cent drop in net income, to $4.01 billion, because of lower gains in its investment portfolio than it enjoyed in the same period past year.