Welfare benefits targeted in budget

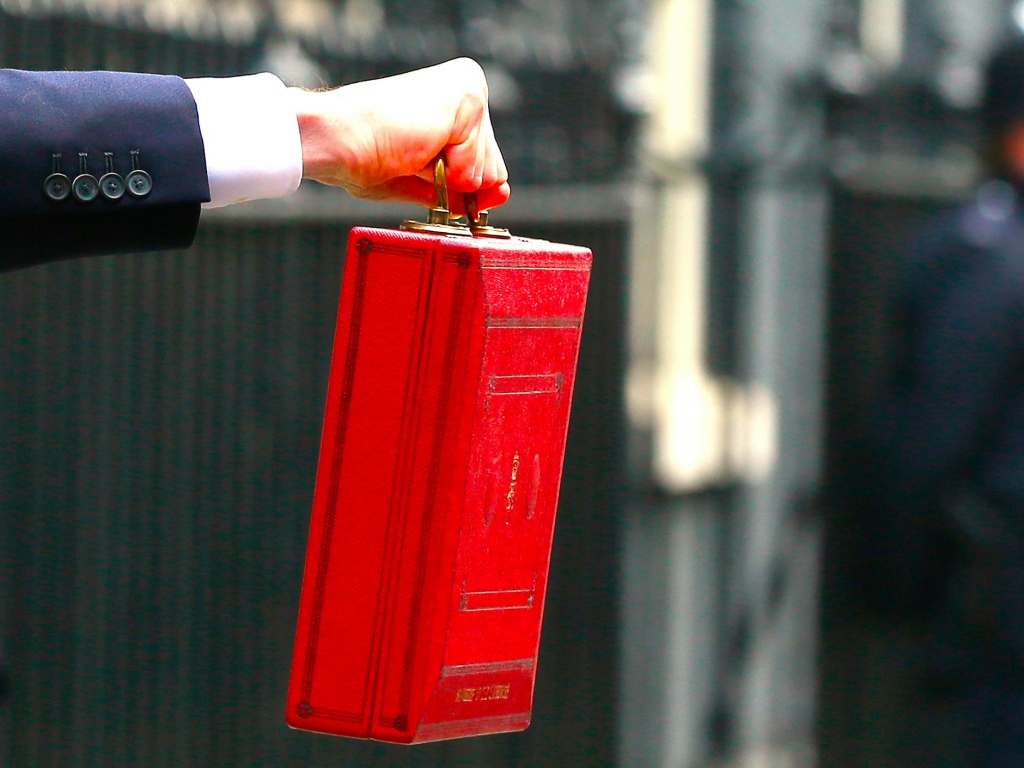

Osborne will have a free hand with public finances after five years of coalition with the centrist Liberal Democrats, while the summer budget comes amid mounting global concern over the debt crisis in anti-austerity Greece.

However, there will be some giveaways to sweeten the pill too. “They perhaps don’t use the shops at all on a Sunday due to their belief but that’s not the case for me”.

Slowing welfare cuts is insufficiently bunny-like, but this does fit the hints that those around the Chancellor were dropping that things might be better than expected in tomorrow’s statement.

David Cameron said at the time that the party was responding to the “most basic, human and natural instinct there is” for parents to be able to pass on something to their children.

The Institute of Directors (IoD) has urged Chancellor, George Osborne to carry out a much-needed tax reform ahead of the first Conservative majority government Budget this week.

There are reports that Mr Osborne will raise the 40p tax threshold from its current level of £42,385. According to the Telegraph, 110,000 of the 440,000 jobs in the civil service could be lost by 2020.

Is £1 million an expensive property in the United Kingdom?

The Chancellor will announce that local authority and housing association tenants on incomes of £40,000 or more in London and £30,000 in the rest of England will have to pay a market, or near market, rent from 2017/18.

Tom McPhail, head of pensions research at broker Hargreaves Lansdown, said: ‘Our great concern is that the Government will simply cap tax breaks for higher earners.

The Budget will reveal the timetable for £12bn welfare cuts by 2017/18 has been extended by at least a year, Sky News understands. Previously a rise to £10,600 in the personal allowance was introduced, however, Mr Osborne is predicted to possibly go even further and increase the threshold at which 40% tax must be paid. He is also expected to restrict tax relief on pensions contributions for those earning more than £150,000 in order to fund an inheritance tax cut, and could change the rates or terms of capital gains tax or stamp duty to raise some extra cash. The Conservative manifesto seemed to imply a commitment to 2017/18, but the IFS points out the wording was a little vague.

“The Government’s got it all the wrong way round, they should instead be looking to increase the minimum wage”, he said.

There is a lot of speculation that tax credits will be significantly revamped. He is determined to cut the deficit but without increasing the largest source of revenue: income tax, national insurance and VAT. It will be raised to £50,000 although don’t necessarily expect this on Wednesday.

She added that there is a lot of misunderstanding around the rules, with many people overlooking the money the status brings in, with non-doms contributing around £8.2bn to the United Kingdom economy in the past year. Mr Johnson has called on Mr Osborne to scrap the 45p rate of income tax, setting out his own stall for the 2020 race to Number 10.