What Wall Street is saying about General Motors Company (NYSE:GM)

They now have a United States dollars 38 price target on the stock.

Summit Materials, Inc. (NYSE:SUM) persists its position slightly strong in context of buying side, while shares price build up 2.81% during latest trading session.

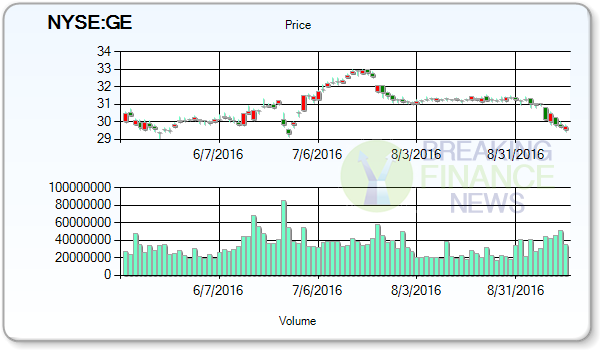

Recently stock market analysts updated their outstanding price targets on shares of General Electric Company (NYSE:GE). Movements above 70 are interpreted as indicating overbought conditions; conversely, movements under 30 reflect oversold conditions.

These brokerages have released the 12-month price targets, as per, which the bearish price target is set at $52. For the reporting quarter, equity analysts expect the stock to deliver $0.45 in earnings per share (EPS).

Sales Estimates: Wall Street Analysts are estimating average sales of $30,041.10M for current quarter (Quarter Ending Sep-16). However a year ago during same quarter General Electric Company (NYSE:GE) reported $0.29 EPS. $0.02 was the standard deviation of estimates before the posted results.

14 analysts are covering General Motors Company (GM) and their average rating on the stock is 2.21, which is read as a Buy. Two investment analysts have rated the stock with a sell rating, nine have assigned a hold rating and twelve have assigned a buy rating to the company’s stock.

General Electric Company had its “equal weight” rating reiterated by analysts at Morgan Stanley.

In General Motors Company (NYSE:GM)’s most recent quarter, EPS moved to $1.86 from $1.26 in prior quarter and revenues reached at $42,372.00M versus $37,265.00M. The stock volatility for week was 1.64% while for month was 1.03%.The stock, as of last close, traded 25.27% to its 52 week low and was changed -10.00% from its 52 week high. GE Digital, an integral part of General Electric Company, purchased Meridium, a global leader in asset performance management (APM) software and services for asset-intensive industries.

When we have a peek on stock’s historical trends we come to know that, the stock has slipped -0.66% in the past one week and plunged -4.41% during previous one month drive, the stock went down -2.25% during past quarter. The company is set at a mean analysts’ recommendation of 2.30. That would represent a 2.27 per cent year-over-year increase.

While taking a glance at financials, we can look at a number of key indicators. The Company also provides automotive financing services through General Motors Financial Company, Inc. The company now has a Return on Equity (ROE) of 11.90% and a Return on Investment (ROI) of 0.90%. But what was reported as EPS estimates for 60 and 90 days ago were $0.5 and $0.5 respectively.

GE has price to earnings ratio of 28.12 and the price to current year EPS stands at -82.30%.

Total debt to equity ratio of the company for most recent quarter is 1.84 whereas long term debt to equity ratio for most recent quarter is 1.47.