Why oil prices are suddenly surging

But analysts said that the cuts are likely to cause other producers, especially US shale drillers, to increase output. A meeting with non-OPEC countries in Moscow on 9 December has been pencilled in.

Crude prices rose almost 5 percent for the month. Now they’re positioned to ramp up output at prices that were once too low to survive on.

On Thursday Azerbaijan said it was also willing to engage in talks on cuts.

“OPEC is still OPEC”, he said. Oil exports are above 90% in countries such as Nigeria, Algeria for the lack of a diversified economy.

Of course, OPEC does have a number of things to be happy about this week. Jefferies Group LLC said “OPEC’s adherence to the agreement will be critical, and its track record is poor”, while compliance by non-OPEC producers is “even more tenuous”.

In the days prior to Wednesday’s deal, the market assigned a low probability that OPEC would come to a meaningful agreement because of arguments between de facto leader Saudi Arabia and third-largest producer Iran. The organization will also have its next meeting on May 25 to monitor the deal and could extend it for six months, Qatar said.

“The Saudis attempted to go to war with the shale producers and they have been fighting it ever since, and I would say they are losing the war not that they are winning it and they have realized that now and they are starting to try to back off of keeping prices low because they are not going to bankrupt the U.S. oil drillers”, he stated.

That said, most sell-side analyst reports we read today remain cautious around the OPEC deal.

The Canadian dollar ticked up to 0.7445 USA dollars from Tuesday’s 0.7442. After first joining in 1962, it left in 2009 as dwindling production meant that Southeast Asia’s most populous country had become a net importer of crude oil, which is against OPEC’s statute for full membership. OPEC also announced about establishment of a “monitoring committee” that would presumably police member countries’ adherence to their respective production quotas.

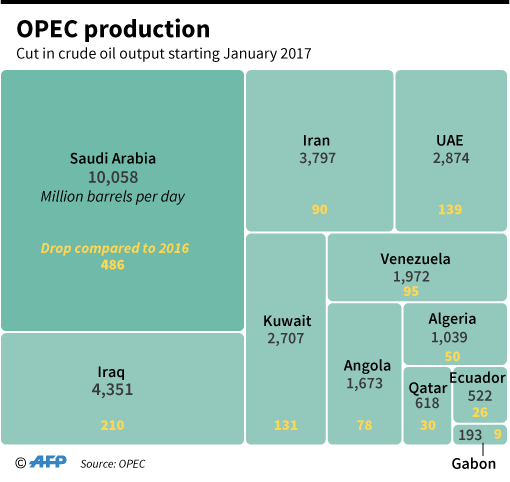

Crude prices boomed by nearly 9% to $49.20 per barrel as investors cheered the long-awaited deal. Iraq, the group’s second-largest producer, agreed to cut by 210,000 barrels a day from October levels.

“They weren’t able to wipe out shale”.

“We have elected a pro-growth president who is going to move very quickly to make some drastic changes, and investors are trying to figure out what to do with that”, said Tom di Galoma, head of Treasury trading at Seaport Global Holdings.

And many anticipate shale will emerge as one of the biggest winners from the OPEC decision.

OPEC agreed to cut oil production on Wednesday.

The potential deal, which was first reported at the beginning of the month, was for a reported 10 billion US dollars.

As a result, prices of Alberta-based energy firms prospered by more than 10 percent on the day. An ounce of bullion dropped 14.40 US dollars to 1176.20. “That’s saved their bacon”, said ClipperData’s Smith.