Will BlackBerry Limited (NASDAQ:BBRY) Beat Analyst Estimates?

The move from hardware to software has not been an easy one for BlackBerry (TSX:BB, Nasdaq:BBRY), and the company will likely announce more restructuring related to its recent acquisition of Good Technologies with tomorrow’s second quarter results, says Cormark analyst Richard Tse. The company has been rated an average of 2.85 by 20 Wall Street Analysts.

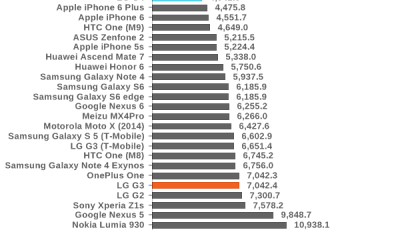

We rate BLACKBERRY LTD (BBRY) a SELL. The company has a market cap of $3.93B and a P/E ratio of 0. The brokerage now has a $7.00 price target on the smartphone producer’s stock.

What is clear, however, is that with BBRY stock down more than 7% after the BlackBerry earnings report posted this morning – and with BBRY shares down 40% year-to-date – investors aren’t interested in sticking around to find out. Robert W. Baird set a $9.00 price target on BlackBerry and gave the stock a hold rating in a research report on Tuesday, June 23rd.

Last quarter – its second fiscal quarter of 2016 – BlackBerry managed to lose 13 cents per share on $490 million in sales. The company’s operating cash flow for the quarter totaled $110 million. The company had a trading volume of 16,626,024 shares. The 52-week low of the share price is $6.41.

BlackBerry Limited has a broker recommendation of 2.85. In the past six months, there is a change of 0% in the total insider ownership.

But last quarter’s software revenue was unimpressive compared to the hype, and the company that was supposed to be less and less concerned about devices somehow saw fit to launch an entirely new kind of phone. Morgan Stanley reaffirmed an equal weight rating and issued a $7.00 price objective on shares of BlackBerry in a research note on Tuesday, September 8th.

BlackBerry Limited has dropped 15.82% during the last 3-month period. The higher and the lower price estimates are $ 14 and $6 respectively. The 50-day moving average is $7.44 and the 200 day moving average is recorded at $8.86. The stock, as of now, is showing weekly upbeat performance of 2.72%, which is maintained at -0.39% in 1-month period.

The company shares have dropped 31.38% in the past 52 Weeks. S&P 500 has rallied 1.82% during the last 52-weeks. Through the development of integrated hardware, software and services, it provides platforms and solutions for seamless access to information, including e-mail, voice, instant messaging, short message service (SMS), Internet and intranet-based applications and browsing. Its portfolio of products, services and embedded technologies are used by thousands of organizations and millions of consumers around the world and include the BlackBerry wireless solution, and the RIM Wireless Handheld product line. The Devices business of the Company’s is focused on delivering products that were smartphone. In September 2014, the Company acquired Movirtu, provider of virtual identity solutions for mobile operators that allows multiple numbers to be active on single device.