Yellen says more interest-rate hikes may be on the horizon

In her prepared statement to the Senate Banking Committee, Federal Reserve Chair Yellen stated that further adjustments in interest rates are likely to be needed, although policy is not on a pre-set course. Indeed, while Yellen declined to specify how fiscal policies will impact the pace at which the Fed will remove its monetary policy accommodation, waiting too long would be “unwise” and could potentially force the FOMC to raise rates too quickly, disrupting financial markets, and raising the risk of a USA recession.

The Fed, she said, expected that the U.S. economy would expand “at a moderate pace”, with inflation gradually rising to the Fed’s 2 per cent target. “Will Yellen give the markets a reality check by voicing some scepticism about potential fiscal change under President Trump?” On the one hand, she did keep alive hopes for a “live” March meeting as headlines on waiting too long to tighten were the initial impetus for today’s Treasury down-trade.

“Consumer spending has continued to rise at a healthy pace, supported by steady income gains, increases in the value of households’ financial assets and homes, favorable levels of consumer sentiment, and low interest rates”, she said.

“U.S. real gross domestic product is estimated to have risen 1.9 percent previous year, the same as in 2015”. Utilities and real estate, which tend to weaken in a rising rate environment, fell. In other words, the FOMC needs to move the fed funds rate much higher – namely above 3% – before monetary policy begins to cool down the economy. Mr Trump has repeatedly called for measures to stimulate economic growth, like tax cuts and infrastructure spending. The hopes raised by his comments helped lift USA stocks to record highs on Monday. Central-bank officials last lifted the Fed-funds rate in December to a range between 0.50% and 0.75%. His resignation, effective in early April, will create a third vacancy on the seven-member board for Trump to fill. Yellen’s term is set to expire on February 3, 2018.

“I do intend to complete my term as chair”.

The dollar stumbled against major currencies overnight after U.S. President Donald Trump’s national security advisor Michael Flynn quit under scrutiny over whether he discussed the possibility of lifting U.S. sanctions on Russian Federation before Trump took office.

Yellen and other Fed bankers have fervently denied the accusations. Investors will be eager to hear whatever Yellen says about them-or doesn’t say. “They need to be people who the market finds credible and respected”. Fed caution will also come into play at some point with a Trump Fed a-coming.

Yellen will testify before the Senate Banking Committee on Tuesday and before the House Financial Services Committee on Wednesday.

Results from American International Group Inc.(AIG) and Fossil Group Inc.(FOSL) are due after the close. The president has pledged to draw investment to the US manufacturing industry, reduce the country’s import consumption and boost its exports. “The nature of NY as a financial center would be put at risk”.

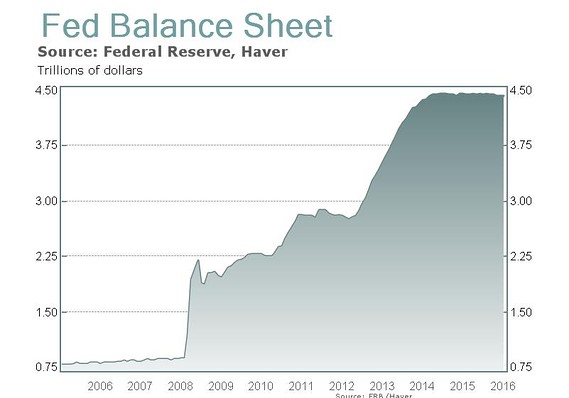

Yellen added the Fed would like to shrink the balance sheet passively.

Some market participants read Yellen’s reference to the Fed raising rates at “upcoming meetings” as indicating that an increase of benchmark rates at the Fed’s March meeting, which Wall Street has been pricing in as unlikely, is still on the table. “I don’t have all the facts at my fingertips, I believe our banks are more profitable”, she said. A few days later, Trump signed an executive order kick-starting his review of current financial regulations and oversight procedures. The act was widely seen as an effort to repeal the curbs put in place after the financial crisis by the Dodd-Frank Act. And that was already a big question even before Yellen’s comments this morning.