Yields rise on hawkish Bank of England, before supply

The inflation bogeyman has reared its ugly head and sent USA stock investors racing for the hills in recent days. The world has turned uglier for stock market bulls and leveraged bond market bulls are on the road to financial suicide, assisted merrily along by a fee-driven Private Bankerji.

If the January’s U.S. consumer price index due next Wednesday from the U.S. Labor Department, and the producer price index the next day, come in higher than the market anticipates, brace for more selling and gyrations for stocks. In the past 21 episodes since 1945 when the 30-year USA bond yield has suffered “significant” spikes, stock prices have only declined in three of those periods.

“We don’t have a lot of panic”.

The CBoe Volatility index.VIX closed at its highest since August 2015.

It’s healthy and normal for equity markets to experience pullbacks – average annual drawdowns in any given year can easily exceed 10% (historically the average largest intra-year decline for the S&P 500 would be around 13%, for example) and on average still deliver positive total returns on a full year basis.

That sign of inflation has market participants anxious that the Federal Reserve will increase interest rates, perhaps more aggressively than the three rate hikes already expected for this year.

“Equities are going to do this until they don’t”, said Art Hogan, chief market strategist at Wunderlich Securities. The deal looks set to increase the US federal deficit and may stimulate inflation, encouraging the Federal Reserve to hike up interest rates quicker than anticipated.

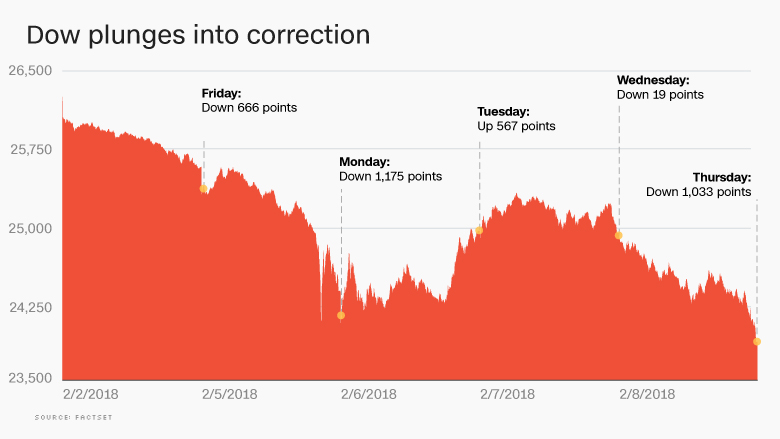

The selloff in world stock indexes deepened on Thursday, with the fall in USA stocks confirming a correction for the market, in another volatile session stirred by concern over rising bond yields.

If equities are offering a yield of 4.07 per cent and 10-year bond 7.56 per cent, one would understand why money is moving away from equities. Furthermore, the sharp rise in United States yields has come at a time when U.S. economic data releases have been more mixed, with the exception of January’s USA employment report. (Though there are several reasons to be cautious about the latest wage data.) That implies higher inflation, which is bad for bonds. The mood “is more frustration than anything else”, Hogan added. The Dow traded up and down in a 1,900-point range this month alone.

Earlier on Thursday, the 10-year US Treasury note yield rose as high as 2.884 per cent, nearing Monday’s four-year peak of 2.885 per cent, after the Bank of England said interest rates probably needed to rise sooner than previously expected. “It was a 2.75% yield that impacted stocks”, he says. Steve Bartolini, who’s a member of T. Rowe Price’s fixed-income team, doesn’t think 10-year Treasury bond yields will rise much further from here.

The Dow Jones Industrial Average rose 104.61 points, or 0.44 percent, to 23,965.07, the S&P 500 gained 15.65 points, or 0.61 percent, to 2,596.65 and the Nasdaq Composite added 36.36 points, or 0.54 percent, to 6,813.52.

“Today it feels like leadership is going back to the rate market and now stocks are reacting to it”, said John Briggs, head of strategy at NatWest Markets. USA government bonds, meanwhile, are considered virtually free of risk of default. The bond market bloodbath led to an ominous (that devil number again!) 666-point fall in Dow Jones Index on Friday.

The stock market isn’t the only thing dropping.

“Investors need to think carefully about their bond exposure”, he said. “The overall market could have taken a cue from some of the bigger names”. For now, our core view is it will be an orderly transition, as equity markets remain underpinned by solid global growth and strong corporate earnings.

“What is says, in general, is that higher interest rates make stocks look more expensive, especially relative to a fixed-income alternative”, said Tim Ghriskey, managing director at Solaris Asset Management.