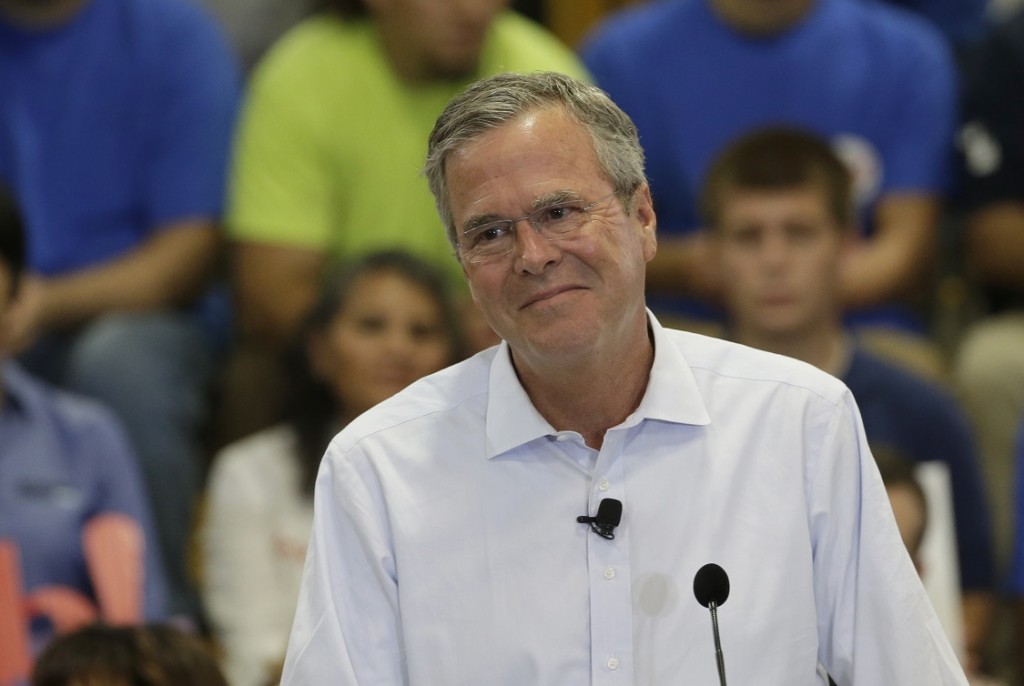

Jeb Bush Set to Unveil Tax Plan in North Carolina

Again, don’t take these numbers as gospel-as one economist memorably put it to the New York Times, some of the Tax Foundation’s recent work “would not pass muster as an undergraduate’s model at a top university”.

In addition, Bush would look for a cut in the headline United States federal corporate tax rate from the current 35 percent to 20 percent, through the repeal of “most” corporate deductions and credits.

Grover Norquist, the founder of Americans for Tax Reform, said the Bush proposals represent sound strategy and a step in the right direction of reducing taxes overall.

The Alliance for Charitable Reform, a group that represents grant makers and donors, gave the plan a warm reception.

In a policy speech laying out his economic proposals, Bush couldn’t resist taking shots at the frontrunners in the 2016 race: “Donald Trump and Hillary Clinton, who he said just “may not believe” we can grow the economy”.

Whether those changes are appealing hardly matters, at this stage. The 28% bracket now starts at $151,200.

Bush would cap the total value of such deductions at 2 percent of adjusted gross income.

To quickly review, Bush would drastically lower tax rates for both individuals and corporations, while eliminating loopholes and a number of popular deductions to make up some of the foregone revenue.

Under Bush’s proposal, the three new brackets would tax income at 28%, 25%, and 10%.

Matt Callahan, president of Callahan Construction and Development, a Raleigh company that operates in 17 states, said he was impressed with Bush’s plan for a tax overhaul.

“It’s a tax code only an army of accountants and lobbyists would love, because they’ve written it”, Bush said.

The former Florida governor “challenged some long-held tenets of conservative tax policy…by proposing to curtail valuable deductions that benefit businesses and the wealthy and eliminate a loophole that has benefited hedge fund and private equity managers for years“. Trump’s headlines may come from his stoking the fears of angry white men about the ongoing (and nonexistent) Latino invasion, but his staying power comes from a serious critique of the Republican establishment. It would simplify the personal income tax form to two pages in many cases and lessen the classes of tax percentage from 7 to 3.

In his remarks, Bush seemed to anticipate the argument that faced Mitt Romney in the 2012 general election.

Bush said that his plan, along with other efforts such as regulatory relief, would double the nation’s economic growth to 4% and create 19 million jobs, growing the tax base.

He also threw an elbow at GOP front-runner Donald Trump, saying, in part, “Now those on the left, and even some people who call themselves Republicans, will tell you that to save U.S.jobs, we have to throw up a bunch of walls and tariffs and protect our businesses from competition”. Unveil a surprise? Here are some key benchmarks to use in evaluating the Bush plan.