Sales slow at trench coat maker Burberry amid weakening demand in Asia

The Americas delivered high single-digit percentage comparable growth, with footfall recovering through the quarter after a soft start.

Upmarket fashion house Burberry (LON:BRBY) reported higher revenue and sales but said Asia and Hong Kong dragged on the numbers.

Burberry Group PLC on Wednesday reported a rise in revenue in the first quarter of its financial year and said profit for the year will be GBP20 million higher than the prior year if exchange rates remain at current levels, although it warned that the increase would be offset by “a more adverse geographic mix”. Retail revenue rose 10 percent to £407 million and eight percent on an underlying basis.

Sohil Chotai, analyst at Edison Investment Research, said the first quarter sales growth was a “good result given the volatility in some of its key markets such as Hong Kong and slowing growth in China”.

The continued challenging luxury environment in Hong Kong, which slowed further to a double-digit percentage decline in LFL sales.

Conlumino Consultant, Andrew Hall, noted: “Burberry is a brand that is still innovative, still a top player in luxury retail and still led by a team that is unlikely to let a stuttering global performance hold it back in the pursuit of quality long-term growth”. “This changing consumer demand has led to a faltering of sales for Burberry, particularly in Hong Kong, where the sales decline reached double digits”.

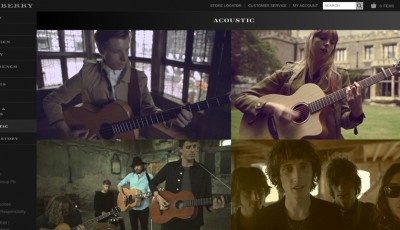

Bailey has expanded the British heritage brand’s digital profile, pioneering live streaming of shows and selling directly from the catwalk.

Shares in Burberry, already down 9 per cent over the last three months after a cut in profit guidance in May, fell up to a further 3.7 per cent, to be the top FTSE 100 faller, despite the group maintaining most of its guidance.

This time a year ago, 52 per cent of shareholders voted against the directors’ remuneration report – this time, activist investor Pirc has urged them to do it again, saying Bailey’s share awards, equivalent to 1,185.4 per cent of his salary, are excessive. PIRC says the CEO’s pay and bonuses were “excessive” and his recruitment awards “inappropriate”.